Municipals were bumped up to a basis point or two Monday, while U.S. Treasuries were firmer out long and equities rallied near the close.

For the third consecutive week, muni yields continued to fall. The 10-year note fell by 21.6 basis points last week to end the week at 3.05%, said Jason Wong, vice president of municipals at AmeriVet Securities,

With yields falling once again, munis outperformed USTs last week “as 10-year munis are now yielding 68.74% compared to the prior week when those ratios were at 70.23%,” he said.

The rally in munis over the last three weeks has “pushed ratios to levels that we have not seen since the start of the year,” he said.

The two-year muni-to-Treasury ratio Monday was at 64%, the three-year at 65%, the five-year at 66%, the 10-year at 68% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 64%, the three-year at 65%, the five-year at 65%, the 10-year at 68% and the 30-year at 87% at 3:30 p.m.

Currently, the 10-year muni-UST ratio is at 68% on Monday, according to Refinitiv MMD. This is down from 74% at the start of the month and 70% on Jan. 3.

The 30-year muni-UST ratio is at 89% on Monday, according to Refinitiv MMD. This is down from 92% on Nov. 1 and 92% on Jan. 3.

“Although this signals that munis are getting expensive, there is some upside to this as yields are about 50 basis points higher now than at the start of the year, something we have all been looking for these past few years,” Wong said. “This rally could potentially push ratios even further as demand picks up and inflows come back to the markets.”

The futures market is now pricing that the next move by the Fed will be to cut the Fed Funds target rate at the March FOMC meeting, said CreditSights strategists Pat Luby and Sam Berzok.

As a result of the shift in market sentiment, CreditSights strategists believe “the muni market will continue to outperform over the next several months into the start of 2024,” driven by reduced supply and increased demand.

“It is not unusual for new-issue volume to wane in the last months of the year, but we expect that the current interest rate conditions will push some issuers into waiting to borrow,” they said.

While “not all borrowers will have the flexibility to delay their plans … we anticipate that some will seek to take advantage of future more favorable interest rates, particularly refunding issues,” CreditSights strategists said.

At the same time, they expect “increased demand from investors who may have been on the sidelines or underweight munis due to recent extreme volatility.”

Increased demand, though, may not “stimulate increased issuance for borrowers, so we look for continued strength in flows into the largest and most liquid ETFs, as investors seek to maintain exposure to munis while waiting for new-issue supply to pick up,” they noted.

They said they also expect “increased retail demand for leveraged closed-end muni bond funds, which are still trading at deep discounts.”

Should outflows from muni mutual funds continue, CreditSights strategists would not be concerned as they believe “much of the outflows have been a result of investors harvesting losses for tax-loss swaps.”

Investors continued to pull money from muni mutual funds, as LSEG Lipper reported $235 million of outflows last week after $151 million of outflows the week prior. This is the 11th straight week of outflows.

As the end of the year approaches, they expect net flows to stabilize.

Secondary trading last week was around $57.11 billion “with 53% of trades being dealer sells,” Wong said.

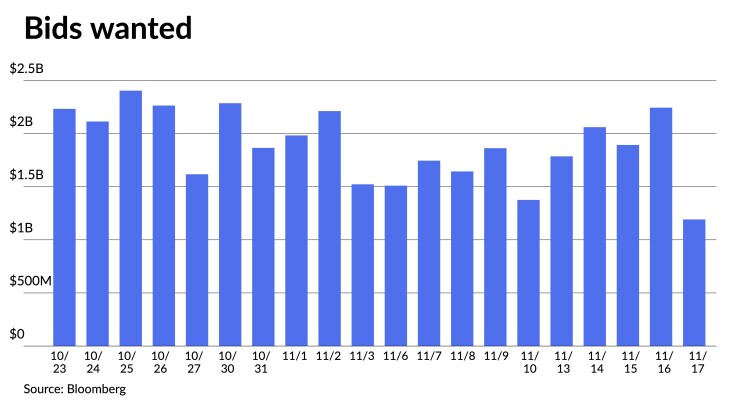

“Bid wanteds were up on the week after clients looked to take advantage of the stronger liquidity conditions, while also selling unfavorable structures and long duration bonds at losses to lock them in before year-end,” Birch Creek Capital strategists said.

Clients put up roughly $9.17 billion for the bid, an increase from the $8.13 billion seen the week prior, according to Bloomberg.

“While most muni participants are very bullish heading into year-end, a look back to last year may help temper some expectations,” Birch Creek strategists said.

November 2022 saw the “IG index post its best monthly performance in over 35 years, up 4.68%, after a weaker CPI report led the market to believe that inflation had peaked and that the Fed could begin cutting by mid-2023,” they said.

The trend continued in early December but “quickly faded as investors took profits, trading desks were lightly staffed, and robust labor markets led investors to fear a higher for longer rate environment,” Birch Creek strategists said.

The IG index “eked out a positive return but liquidity dried up and true bid-sides were far weaker. With another CPI print and a payrolls report before the Fed’s December meeting, we wouldn’t be surprised if there is still some volatility left in the tank for 2023 as IG munis will likely move in sympathy with Treasuries,” they said.

Secondary trading

Boston 5s of 2024 3.20%. Connecticut 4s of 2025 at 3.22% versus 3.25% Thursday. DASNY 5s of 2026 at 3.14% versus 3.21% on 11/14 and 3.29%-3.27% on 11/10.

Maryland 5s of 2027 at 2.96%. Washington 5s of 2028 at 3.00% versus 3.10%-3.05% original on Wednesday. North Carolina 5s of 2029 at 3.01% versus 3.07%-3.02% Thursday.

DC 5s of 2032 at 3.03% versus 3.12%-3.10% Friday and 3.23%-3.25% Thursday. California 5s of 2033 at 3.02% versus 3.17%-3.10% Thursday. Louisiana 5s of 2034 at 3.07% versus 3.10% Friday and 3.23%-3.21% Thursday.

NYC 5s of 2045 at 4.17%-4.16% versus 4.44% on 11/13. Massachusetts 5s of 2052 at 4.31% versus 4.41% Thursday and 4.34% Wednesday.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.25% and 3.14% in two years. The five-year was at 2.92%, the 10-year at 3.01% and the 30-year at 4.07% at 3 p.m.

The ICE AAA yield curve was bumped up to three basis points: 3.25% (unch) in 2024 and 3.13% (-2) in 2025. The five-year was at 2.92% (-2), the 10-year was at 3.01% (-2) and the 30-year was at 4.02% (-3) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.24% in 2024 and 3.11% in 2025. The five-year was at 2.97%, the 10-year was at 3.04% and the 30-year yield was at 4.05%, according to a 3 p.m. read.

Bloomberg BVAL was bumped one to two basis points: 3.23% (-2) in 2024 and 3.17% (-1) in 2025. The five-year at 2.93% (-2), the 10-year at 3.02% (-1) and the 30-year at 4.03% (-1) at 3:30 p.m.

Treasuries were firmer out long.

The two-year UST was yielding 4.910% (+2), the three-year was at 4.632% (+1), the five-year at 4.440% (flat), the 10-year at 4.421% (-2), the 20-year at 4.771% (-3) and the 30-year Treasury was yielding 4.569% (-2) at 3:30 p.m.