Municipals were little changed Thursday as muni mutual funds saw inflows top $1 billion. U.S. Treasuries were firmer, and equities ended up.

The two-year muni-to-Treasury ratio Thursday was at 64%, the three-year at 63%, the five-year at 61%, the 10-year at 60% and the 30-year at 82%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the three-year at 62%, the five-year at 61%, the 10-year at 61% and the 30-year at 81% at 3:30 p.m.

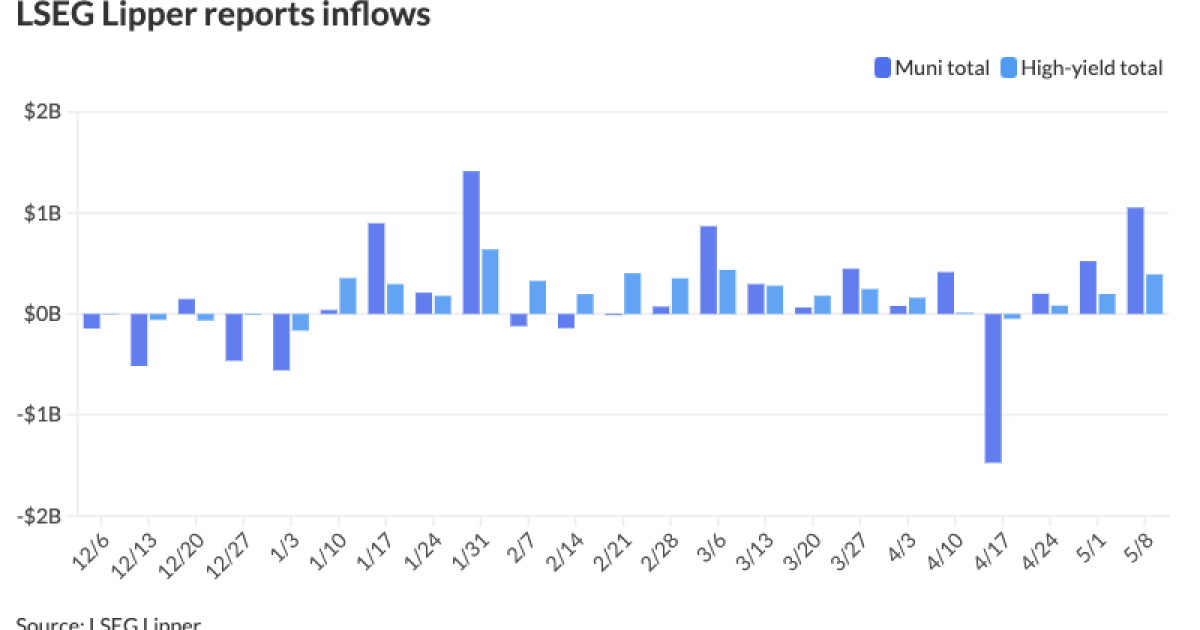

Municipal bond mutual funds saw another week of inflows as investors added $1.053 billion in the week ending Wednesday after $522.2 million the week prior, according to LSEG Lipper. This is the second-largest amount of inflows year-to-date.

High-yield funds also saw inflows to the tune of $391.9 after $197.2 million of inflows the week prior, LSEG Lipper reported.

Muni mutual funds are seeing positive inflows year-to-date, a reversal from outflows in 2022 and 2023, said James Welch, a portfolio manager at Principal Asset Management.

Mutual fund flows have “waxed and waned” year-to-date, said Taylor Huffman, a client portfolio manager at PTAM.

January saw inflows before three weeks of outflows in February. From there, there have been inflows sans the

This, Huffman said, is somewhat similar to the volatility seen in the bond market, as market participants deal with the uncertainty of Fed rate cuts.

Even with this uncertainty, there is a strong demand for fixed income, she said.

“The market generally has grappled with the timing of Fed cuts, when they’re going to happen, how they’re going to happen, why they’re going to happen,” Huffman said.

Federal Reserve Chair Jerome Powell’s press conference after the Federal Open Market Committee meeting last week “ignited” interest in fixed income, which carried into the muni market, she said.

Fed expectations have been a “significant roller coaster ride,” going from at least seven rate cuts coming into the year to “nothing priced in or pretty close to zero at one point,” said Mike Goosay, chief investment officer of global fixed income at Principal Asset Management.

Despite that, markets have “held together pretty well,” he noted.

Inflation may remain a “bit stickier” than some market participants are comfortable with, but that does not prevent the Fed from cutting rates in late summer or early fall, according to Goosay.

The probability of more than two rate cuts this year is “pretty low” given the remaining FOMC meetings and the upcoming election, with the Fed in “a bit of a holding pattern” during that time, he said.

The Fed is likely to cut rates this year even though inflation is unlikely to move below 2%, Goosay said.

Meanwhile, supply is up 31% year-to-date to $152.514 billion, helped by the

Part of the increase in sizable deals stems from the issuers’ need to tap the capital market due to the waning fiscal stimulus, he said.

Additionally, Build America Bonds play a role as issuers are

Supply is expected to remain healthy for the next several weeks.

The New York City Transitional Finance Authority is set to price May 15 $1.8 billion of future tax-secured subordinate bonds in both the negotiated and competitive market.

The Dormitory Authority of the State of New York is set to price May 15 $965 million of School Districts Revenue Bond Financing Program revenue bonds.

The Airport Commission of the City and County of San Francisco is set to price May 14 $925 million of revenue refunding bonds for the San Francisco International Airport.

The Burbank-Glendale-Pasadena Airport Authority is set to price the week of May 20 $790 million of airport senior revenue bonds.

In the primary market Thursday, J.P. Morgan priced for Columbus, Ohio, (Aaa/AAA/AAA/) $467.455 million various purpose GOs. The first tranche, $293.755 million of tax-exempt unlimited tax bonds, Series 2024A, saw 5s of 8/2025 at 3.24%, 5s of 2029 at 2.79%, 5s of 2034 at 2.88%, 5s of 2039 at 3.24% and 5s of 2044 at 3.68%, callable 8/15/2034.

The second tranche, $22.29 million of tax-exempt limited tax bonds, Series 2024B, saw 5s of 8/2025 at 3.24%, 5s of 2029 at 2.79%, 5s of 2034 at 2.88% and 5s of 2039 at 3.24%, callable 8/15/2034.

The third tranche, $76.72 million of taxable unlimited tax bonds, Series 2024C, saw all bonds price at par: 5.024s of 8/2025, 4.712s of 2029, 4.878s of 2034 and 5.148s of 2039, callable 8/15/2034.

The fourth tranche, $15.385 million of taxable limited tax bonds, Series 2024D, saw all bonds price at par: 5.024s of 8/2025, 4.712s of 2029, 4.878s of 2034, 5.148s of 2039 and 5.247s of 2041, callable 8/15/2034.

The fifth tranche, $59.305 million of tax-exempt unlimited tax refunding bonds, Series 2024-1, saw 5s of 2/2025 at 3.32%, 5s of 2029 at 2.83%, 5s of 2034 at 2.86% and 5s of 2035 at 2.92%, callable 8/15/2034.

Jefferies priced for the New Jersey Health Care Facilities Financing Authority (A1/AA-//) $254 million of RWJ Barnabas Health refunding bonds, Series 2024B, with 5s of 7/2029 at 3.05% and 5s of 2036 at 3.21%, callable 7/1/2034.

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 3.23% (-2) and 3.07% (unch) in two years. The five-year was at 2.72% (unch), the 10-year at 2.69% (unch) and the 30-year at 3.77% (unch) at 3 p.m.

The ICE AAA yield curve was cut up to one basis point: 3.23% (unch) in 2025 and 3.08% (+1) in 2026. The five-year was at 2.74% (+1), the 10-year was at 2.71% (+1) and the 30-year was at 3.75% (+1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged two-years and out: The one-year was at 3.25% (-4) in 2025 and 3.06% (unch) in 2026. The five-year was at 2.69% (unch), the 10-year was at 2.68% (unch) and the 30-year yield was at 3.76% (unch), according to a 3 p.m. read.

Bloomberg BVAL was bumped up to one basis point: 3.31% (-1) in 2025 and 3.11% (-1) in 2026. The five-year at 2.65% (unch), the 10-year at 2.63% (-1) and the 30-year at 3.79% (unch) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.814% (-3), the three-year was at 4.620% (-4), the five-year at 4.470% (-3), the 10-year at 4.454% (-4), the 20-year at 4.705% (-3) and the 30-year at 4.609% (-3) at 3:45 p.m.