Municipals were firmer Thursday as a billion-plus dollar deal from the New Jersey Transportation Trust Fund Authority priced in the primary market and outflows continued. U.S. Treasury yields fell and equities ended down.

Triple-A yields fell one to five basis points, depending on the scale, while UST were better by six to 10.

The two-year muni-to-Treasury ratio Thursday was at 65%, the three-year at 66%, the five-year at 67%, the 10-year at 69% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 64%, the three-year at 65%, the five-year at 65%, the 10-year at 67% and the 30-year at 86% at 4 p.m.

The tone of the market has improved, said Stephen Shutz, head of tax-exempt fixed income and a portfolio manager at Brown Advisory.

“Demand is firming up. Interest rates have moved off the recent highs. Intermediate muni yields are about 50 basis points off from those highs,” he said.

He said the improvement is being driven by economic data and the presumption the Fed is done hiking interest rates.

However, “there’s a tremendous amount of volatility that continues to take center stage in the market,” he added.

So far in November, there have been “material moves” — up or down more than five basis points — in the 10-year AAA BVAL on four out of 10 sessions, approaching the six total for all of October, said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

“To say volatility has become a daily constant mirrors a similar back-and-forth in the UST market,” she said.

Volatility in the muni market is still a little concerning, which some of it driven by Treasury rate volatility, Shutz said.

Munis “seem to be more willing to wait a day or two when we have selloffs in the Treasury market,” he said.

Most of the Treasury market volatility is driven by either data releases, like Tuesday’s strong consumer price index print, or Treasury announcements for issuance, according to Shutz.

This can lead to outsized moves in Treasury rates, which can influence the muni market.

However, he noted that it’s encouraging that on days when USTs yields are spiking, for whatever reason, the muni market “is willing to hold on a little bit and see if it’s a temporary move.”

This week saw some large deals coming to market, including a $1.25 billion deal from the New Jersey Transportation Trust Fund Authority.

In the primary market Thursday, Wells Fargo Bank priced and repriced for the New Jersey Transportation Trust Fund Authority (A2/A-/A/A/) $1.25 billion of transportation program bonds, Series BB, with yields bumped up to 12 basis points: 5s of 6/2032 at 3.51% (-7), 5s of 2033 at 3.57% (-6), 5s of 2038 at 4.10% (-12), 5s of 2043 at 4.49% (-8), 5s of 2046 at 4.67% (-6) and 5.25s of 2050 at 4.78% (-6), callable 12/15/2033

BofA Securities priced for the Indianapolis Local Public Improvement Bond Bank (Aaa/AA+/AAA/) $155 million of ad valorem property tax-funded project bonds, Series 2023D, with 6s of 2/2037 at 3.70%, 6s of 2038 at 3.80%, 6s of 2043 at 4.06% and 6s of 2048 at 4.26%, callable 2/1/2033.

Morgan Stanley priced for the Maine Health and Higher Educational Facilities Authority (AA//) $122.42 million of Assured Guaranty-insured revenue refunding bonds, Series 2023B, with 5s of 7/2024 at 3.50%, 5s of 2028 at 3.29%, 5s of 2033 at 3.51%, 5s of 2038 at 4.19%, 5.25s of 2043 at 4.50%, 5.25s of 2048 at 4.74% and 4.75s of 2053 at 5.00%, callable 7/1/2033.

This week also saw an acceleration of deals, Shutz said.

The District of Columbia came to market a day early on Tuesday with $1 billion-plus of income tax-secured revenue bonds, and the Louisiana Offshore Terminal Authority came to market Wednesday with $205 million of deepwater port revenue bonds.

For the month overall, there have been 40 unique new issues that have “priced with $100 million or greater par values — signifying that allocations to the asset class continue despite the significant move lower in yield (witness the growing number of global investment firms touting the taxable equivalent yields related to municipal bonds),” Olsan said.

It’s possible that sidelined during October’s selloff “may be cycling back to in-the-money economics, a potential dark horse to December’s syndicate activity should current rates hold or rally further,” she said.

Following the Federal Open Market Committee meeting, Olsan said “new-issue business has been steady albeit more active at the local level.”

High-grade municipalities remain in high demand, she noted.

For example, a $30 million sale of Roanoke, Virginia, GOs “drew 22 bidding groups with the front end of the scale spread on or through respective AAA spots,” she said.

The demand in the new-issue market can create price leadership that can help drive additional demand, Shutz said.

Some may worry that an excess of supply would create some additional volatility, but he said “there is enough demand out there and the deals that we’re seeing come, and it’s the level of oversubscription that builds confidence within the investor base.”

When investors see deals getting done and bumped to tighter spreads, Shutz said that creates additional comfort for investors where they’ll be more willing to put money to work.

For the remainder of the year, supply will be limited, as there are only a handful of weeks left in a year with a holiday or a Fed meeting, he said.

Issuers will sit on the sidelines during the Fed meeting in early December and weeks when there are bigger economic releases, Shutz noted.

Next year, though, will most likely be a pickup in supply, “which will be pretty easily digested by the market and then hopefully, demand starts to continue to improve with mutual fund flows and things like that.”

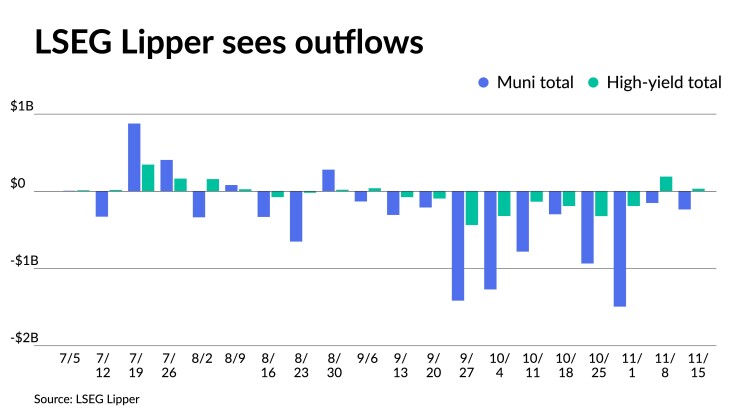

Outflows from muni mutual funds continued, with LSEG Lipper reporting investors pulled $234.9 million for the week ending Wednesday after $151.1 million of outflows the week prior.

High-yield saw inflows of $33.7 million after inflows of $190.4 million the previous week.

However, Shutz said there could be a return of inflows into muni mutual funds.

“We haven’t seen a recovery in open-end mutual fund flows like we would expect to come out of last year’s record outflows,” he said.

But “when I look at how hard it is to go out there and find bonds, I think that investors will lean towards mutual funds when they want to get exposure to the market, because they know that they’ll be able to get fully invested relatively quickly,” he said. “If retail investors, who typically buy mutual funds, believe that the Fed is done hiking rates there may broad-based demand come back into the market.”

Secondary trading

Texas 5s of 2024 at 3.41% versus 3.59% on 11/7. Massachusetts 5s of 2024 at 3.31% versus 3.33% Wednesday. NYC TFA 5s of 2025 at 3.23% versus 3.26% Wednesday.

NYC TFA 5s of 2028 at 3.02%-2.99%. Washington 5s of 2029 at 3.04%-3.05% versus 3.09% Wednesday. Connecticut 5s of 2030 at 3.13%.

California 5s of 2033 at 3.17%. NYC 5s of 2035 at 3.36%-3.35%. Maryland 5s of 2036 at 3.31%.

NYC 5s of 2051 at 4.42% versus 4.42% Wednesday and 4.45%-4.40% Tuesday. Massachusetts 5s of 2052 at 4.41% versus 4.34% Wednesday and 4.74% on 11/2.

AAA scales

Refinitiv MMD’s scale were bumped three to five basis points: The one-year was at 3.27% (-3) and 3.14% (-3) in two years. The five-year was at 2.95% (-5), the 10-year at 3.05% (-5) and the 30-year at 4.09% (-3) at 3 p.m.

The ICE AAA yield curve was bumped one to five basis points: 3.27% (-1) in 2024 and 3.17% (-3) in 2025. The five-year was at 2.96% (-5), the 10-year was at 3.05% (-5) and the 30-year was at 4.06% (-4) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped four basis points: The one-year was at 3.27% (-4) in 2024 and 3.14% (-4) in 2025. The five-year was at 3.00% (-4), the 10-year was at 3.07% (-4) and the 30-year yield was at 4.07% (-4), according to a 3 p.m. read.

Bloomberg BVAL was bumped four to five basis points: 3.28% (-4) in 2024 and 3.22% (-4) in 2025. The five-year at 2.99% (-5), the 10-year at 3.08% (-5) and the 30-year at 4.08% (-4) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.843% (-8), the three-year was at 4.592% (-9), the five-year at 4.432% (-10), the 10-year at 4.454% (-8), the 20-year at 4.830% (-6) and the 30-year Treasury was yielding 4.630% (-6) near the close.