Municipals were mostly steady Wednesday as investors worked through more new-issue paper in the primary while U.S. Treasuries lost ground after Tuesday’s rally. Equities were mixed near the close.

The dust settled Wednesday following Tuesday’s rally, as municipals were flat, according to a New York trader.

“Everyone is reevaluating and taking a breather after the numbers [on Tuesday],” he said.

Triple-A muni yields were little changed while USTs saw yields climb up to 12 on the short end.

Since the positive moves began early in the month, municipal to UST ratios have fallen. The two-year muni-to-Treasury ratio Wednesday was at 64%, the three-year at 64%, the five-year at 66%, the 10-year at 68% and the 30-year at 88%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 66%, the three-year at 67%, the five-year at 67%, the 10-year at 70% and the 30-year at 88% at 3:30 p.m.

In the primary market Wednesday, Wells Fargo Bank priced for the South Dakota Housing Development Authority (Aaa/AAA//) $215 million of homeownership mortgage bonds. The first tranche, $105 million of non-AMT bonds, Series 2023G, saw all bonds price at par: 3.55s of 11/2024 at 3.55%, 3.875s of 5/2028, 3.9s of 11/2028, 4.25s of 5/2033, 4.25s of 11/2033, 4.65s of 5/2039, 4.9s of 11/2043 and 5.125s of 5/2049, except for 6/25s of 5/2055 at 4.85%, callable 5/1/2032.

The second tranche, $40 million of taxables, Series 2023H, saw all bonds price at par: 5.468s of 11/2024, 5.529s of 5/2028, 5.579s of 11/2028, 5.99s of 5/2033, 6.011s of 11/2033, 6.091s of 11/2038, 6.266 at 5/2040 and 6/009s of 5/2054, callable 5/1/2032.

The third tranche, $70 million of non-AMT term rate bonds, Series 2023J, saw 3.875s of 11/2055 with a mandatory tender of 12/12/2024 at par, callable 9/12/2024.

J.P. Morgan Securities priced for the Louisiana Offshore Terminal Authority (A3//A-/) $175.530 million of non-AMT deep-water port revenue bonds. The first tranche, $81.020 million of Series 2007A, saw 4.15s of 9/2027 price at par, noncall.

The second tranche, $56.550 million of Series 2013A, saw 4.2s of 9/2033 with a mandatory tender of 9/1/2028 price at par, noncall.

The third tranche, , $37.960 million of Series 2013, saw 4.2s of 9/2033 with a mandatory tender of 9/1/2028 price at par, noncall.

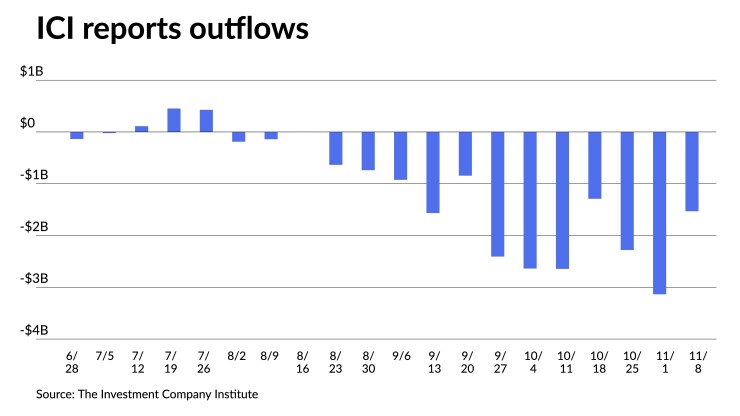

Municipal mutual fund losses slowed last week as the Investment Company Institute Wednesday reported investors pulled $1.531 billion from the funds in the week ending Nov. 8 after $3.136 billion of outflows the previous week.

Exchange-traded funds saw another week of inflows to the tune of $1.876 billion after inflows of $929 million the week prior, according to ICI.

The large rally that has marked the first two weeks of November has lessened October losses, but for the remainder of the year, rates will continue to be affected by several factors, including geopolitics, macroeconomic risks, Fed policy uncertainty and states and municipalities potentially bringing more bonds to market, noted Jeff Timlin, a managing partner at Sage Advisory.

“It’s going to be very challenging to figure out where things are going to end even though we’re getting very close to the end of the year,” he said.

Any of those factors, Timlin said, could pull rates one way or another.

While this week has brought a much larger new-issue calendar, another scarce week is expected next week due to the Thanksgiving holiday.

“People probably want to get that off their plates and get situated before the end of the year,” Timlin said.

At the same time, bid wanted lists are “extremely heavy,” the New York trader noted. “We’re in a little bit of a conundrum — what it means is that profitability at year-end could be a struggle without deals,” he said.

Bond Buyer 30-day visible supply sits at $6.29 billion.

Unless deals pick up the market would have to rely on secondary trading where there are tight spreads.

There will be a bit of a push after Thanksgiving through the first couple of weeks of December, but many “people are trying to wrap up their book [and] figure out how they want to be positioned going into year-end,” Timlin said.

Even if it’s not broadly based, Timlin said there will be a “segment of the market probably trying to accomplish that because next week is probably going to be a little more sporadic, particularly if you have to sell,” he said.

The New York trader said if rates keep dropping, refunding deals could tick up and pick up some of the supply slack.

Tuesday’s strength follows the rally of the past two weeks, and catapulted after the consumer price index number, which slowed to 3.2% last month on a year-over-year basis, lower than the 3.7% reading in September and the lowest since July — and talk of the Federal Reserve Board possibly being done raising rates, noted Bill Walsh, president at Hennion & Walsh Inc.

“We saw yields down 10 to 15 basis points already this week,” Walsh said. “Retail demand seems to be steady even with the present market strength, which at this point it seems like this strength may continue.”

AAA scales

Refinitiv MMD’s scale were bumped up to two basis points: The one-year was at 3.30% (unch) and 3.17% (unch) in two years. The five-year was at 3.00% (unch), the 10-year at 3.10% (unch) and the 30-year at 4.12% (unch) at 3 p.m.

The ICE AAA yield curve was bumped up to two basis points: 3.27% (-1) in 2024 and 3.20% (-2) in 2025. The five-year was at 3.01% (-1), the 10-year was at 3.10% (-1) and the 30-year was at 4.10% (unch) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.31% in 2024 and 3.18% in 2025. The five-year was at 3.04%, the 10-year was at 3.11% and the 30-year yield was at 4.11%, according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 3.32% in 2024 and 3.26% in 2025. The five-year at 3.04%, the 10-year at 3.13% and the 30-year at 4.12% at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.921% (+11), the three-year was at 4.686% (+12), the five-year at 4.529% (+11), the 10-year at 4.538% (+10), the 20-year at 4.893% (+8) and the 30-year Treasury was yielding 4.690% (+8) at 3:45 p.m.

Primary to come

The New Jersey Transportation Trust Fund Authority (A2/A-/A/A/) is set to price Thursday $1.25 billion of transportation program bonds, Series BB, serials 2032-2050. Wells Fargo Bank.

The Indianapolis Local Public Improvement Bond Bank (Aaa//AAA/) is also set to price Thursday $155 million of ad valorem property tax-funded project revenue bonds. BofA Securities.

The Municipal Improvement Corp. of Los Angeles (Aa3//AA-/) is set to price Thursday $193.92 million of lease revenue bonds, Series 2023-A, serials 2024-2043. RBC Capital Markets.

The Massachusetts Housing Finance Agency (Aa2/AA+//) is set to price Thursday $177.46 million of non-AMT sustainability bonds, consisting of $50.505 million of Series C-1 bonds, serials 2026-2035, terms 2038, 2043, 2048, 2053, 2058, 2063 and 2066; $124.755 million of Series C-2 bonds, serials 2027-2028; and $2.2 million of Series D bonds, serial 2024. BofA Securities.