Municipals were mixed Thursday, largely sitting out another swing to higher yields in U.S. Treasuries after Federal Reserve Chairman Jerome Powell said the central bank would not hesitate to hike interest rates further if needed. Equities sold off.

Triple-A yields barely budged while USTs saw yields rise by 10 to 14 basis points following a rough 30-year auction.

Municipal to UST ratios fell as a result. The two-year muni-to-Treasury ratio Thursday was at 65%, the three-year at 67%, the five-year at 67%, the 10-year at 69% and the 30-year at 88%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 67%, the three-year at 69%, the five-year at 68%, the 10-year at 71% and the 30-year at 90% at 4 p.m.

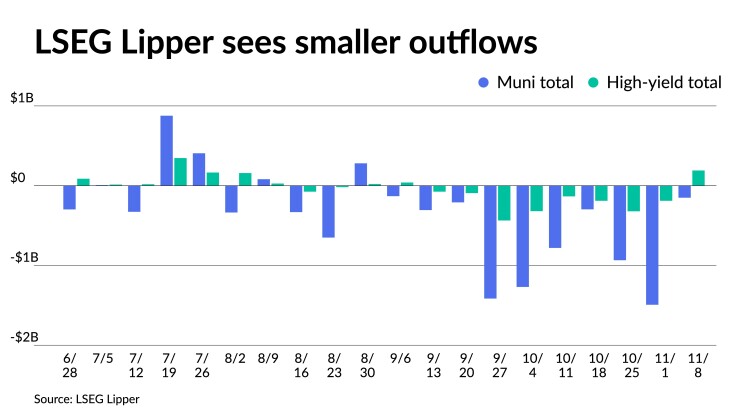

Following on the heels of a six-consecutive session muni rally, outflows slowed from muni mutual funds with LSEG Lipper reporting investors pulled $151.1 million for the week ending Wednesday after $1.493 billion of outflows the week prior.

High-yield saw inflows of $190.4 million after outflows of $189.8 million the previous week.

In the primary market Thursday, the Texas Municipal Gas Acquisition and Supply Corp. (A2///) jumped into the market with $1.477 billion of gas supply revenue bonds.

BofA Securities priced for the first tranche, $789.570 million of Series 2023A bonds, with 5.25s of 1/2025 at 4.63%, 5.25s of 2028 at 4.64% and 5.25s of 2030 at 4.75%, callable 7/1/2029.

The second tranche, $687.845 million of Series 2023B bonds, saw 5.25s of 1/2025 at 4.63%, 5.25s of 2028 at 4.64%, 5.5s of 2033 at 4.91% and 5.5s of 2034 at 4.95%, callable 7/1/2029.

BofA Securities priced for the Westchester County Local Development Corp. (/AA//AA+) $288.295 million of revenue bonds (Westchester Medical Center Obligated Group Project), with 5.25s of 11/2031 at 4.01%, 5.25s of 2033 at 4.08%, 5.75s of 2048 at 5.07% and 5.75s of 11/2053 at 5.13%, callable 11/1/2033.

Wells Fargo Bank priced for the Hampton Roads Transportation Accountability Commission (Aa3/AA//) $141 million of Hampton Road Transportation Fund intermediate lien bond anticipation notes, Series 2023A, with 5s of 7/2027 at 3.40%, noncall.

Powell’s speech put an end to the UST rally while munis reacted less so to his comments.

The broader fixed income market “caught a break last week after the Fed and Treasury Department both provided positive catalysts to Treasury markets,” said Lawrence Gillum, chief fixed income strategist for LPL Financial.

As expected, he noted “the Fed kept its policy rate unchanged but seemingly acknowledged the risks were balanced between doing too much versus doing too little.”

As such, he said “markets took that acknowledgment as the Fed was done raising rates, which has historically been a good thing for bond markets (more on this later).”

However, Powell indicated Thursday that the Fed would not hesitate to tighten further if necessary.

Even if the Fed hikes rates further — one additional rate hike is already a possibility, even before Powell spoke Thursday — “munis, which can provide additional tax-exempt income in higher-rate environments, have generated attractive after-tax returns at the end of Fed rate hiking campaigns,” Gillum said.

Over the last four rate hiking cycles, he noted “munis averaged a 9% after-tax return over the 12-month period after the Fed was done raising rates.

Additionally, he said muni returns were positive in each of those periods.

Whenever the Fed stops hiking rates, Gillum said “the muni market will likely go back to trading largely on internal dynamics which remain largely positive.”

Issuance for the remainder of the year will slow, Gillum said, noting “average tax-exempt supply typically falls to below-average levels from November to February.”

The reduction in supply tends to be “good for muni returns,” he said.

Since 2011, Gillum said “the average return for the muni index has been positive from November through February.”

So far, this year “has bucked the trend so the typical seasonal patterns may not hold throughout the rest of the year.”

The most recent Fed data shows retail investors remain the largest ownership block of holders, with banks and insurance companies also large holders, he said.

“So, despite higher yields, record outflows from retail investors in 2022 have been followed by further outflows this year,” he noted.

“Despite still strong fundamentals and improved valuations, retail investors have, so far, been unwilling to stay the course, which has offset most of the favorable supply dynamics,” Gillum said.

Until retail investor outflows slow or reverse, he said “the typical seasonal patterns may not hold.”

But if the seasonal patterns do hold, he said “muni investors could end the year with a positive tailwind to returns.”

New-issue calendar

The new-issue muni calendar is estimated at $3.396 billion next week with $2.045 billion of negotiated deals on tap and $1.351 billion on the competitive calendar, according to Ipreo and The Bond Buyer.

The New Jersey Transportation Trust Fund Authority leads the negotiated calendar with $1.25 billion of transportation program bonds, followed by $668.91 million of tax-exempt income tax secured revenue bonds from the District of Columbia.

The competitive calendar is led by $381.610 million of State Appropriations Mega Projects state road bonds from the Missouri Highways and Transportation Commission.

Secondary trading

California 5s of 2024 at 3.34% versus 3.43% Wednesday. Washington 5s of 2025 at 3.42%. Connecticut 5s of 2025 at 3.40%.

Harford County, Maryland, 5s of 2028 at 3.15% versus 3.17% Wednesday. Delaware 5s of 2029 at 3.11% versus 3.20% Tuesday. Oregon 5s of 2029 at 3.13%-3.12% versus 3.30% on 11/3 and 3.60% on 10/30.

DASNY 5s of 2033 at 3.36%-3.35% versus 3.51%-3.48% Tuesday. NYC TFA 5s of 2034 at 3.44% versus 3.47% Wednesday and 3.85%-3.86% on 11/2. San Jose Financing Authority 5s of 2035 at 3.22%-3.20%.

Massachusetts 5s of 2049 at 4.40% versus 4.83% on 10/31. NYC TFA 5s of 2053 at 4.53%-4.54% versus 4.57%-4.56% Wednesday and 5.00%-4.99% on 11/1.

AAA scales

Refinitiv MMD’s scale was cut up to two basis points: The one-year was at 3.42% (unch) and 3.29% (unch) in two years. The five-year was at 3.12% (unch), the 10-year at 3.20% (unch) and the 30-year at 4.22% (+2) at 3 p.m.

The ICE AAA yield curve was bumped up to four basis points: 3.38% (-4) in 2024 and 3.34% (-3) in 2025. The five-year was at 3.12% (-3), the 10-year was at 3.21% (-1) and the 30-year was at 4.19% (unch) at 4 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.43% in 2024 and 3.30% in 2025. The five-year was at 3.15%, the 10-year was at 3.21% and the 30-year yield was at 4.20%, according to a 3 p.m. read.

Bloomberg BVAL was cut one to two basis points: 3.46% (+2) in 2024 and 3.39% (+2) in 2025. The five-year at 3.17% (+2), the 10-year at 3.25% (+2) and the 30-year at 4.22% (+2) at 4 p.m.

Treasuries sold off.

The two-year UST was yielding 5.034% (+10), the three-year was at 4.802% (+12), the five-year at 4.652% (+14), the 10-year at 4.635% (+12), the 20-year at 4.975% (+14) and the 30-year Treasury was yielding 4.772% (+13) at the close.

Primary to come

The New Jersey Transportation Trust Fund Authority (A2/A-/A/A) is set to price Thursday $1.25 billion of transportation program bonds, Series BB, serials 2032-2050. Wells Fargo Bank, N.A. Municipal Finance Group.

The District of Columbia (Aa1/AAA/AA+/) is set to price $668.91 million of income tax-secured revenue and refunding bonds, consisting of $482.230 million of Series 2023A, serials 2037-2043, term 2048, and $186.68 million of refunding revenue bonds, serials 2024, 2031-2033. Citigroup Global Markets Inc.

The Indianapolis Local Public Improvement Bond Bank is set to price Wednesday $236.83 million of Convention Center Hotel senior and subordinate revenue bonds, consisting of $184.625 million of Series 2023E senior bonds (/BBB-//) and $52.205 million of subordinate bonds (nonrated). Piper Sandler & Co.

The Indianapolis Local Public Improvement Bond Bank is also set to price Wednesday $200 million of Convention Center Hotel Subordinate revenue bonds (/AA//), insured by Build America Mutual Assurance Co. Piper Sandler & Co.

The Louisiana Public Facilities Authority (Aaa///) is set to price $204.215 million of solid waste disposal facility revenue bonds (Elementus Minerals, LLC Project). Piper Sandler & Co.

The Municipal Improvement Corporation of Los Angeles (Aa3//AA-/) is set to price Thursday $193.92 million of lease revenue bonds, Series 2023-A, serials 2024-2043. RBC Capital Markets.

The Massachusetts Housing Finance Agency (Aa2/AA+//) is set to price Thursday $177.46 million of non-AMT sustainability bonds. BofA Securities.

The Virginia Housing Development Authority (Aa1/AA+//) is set to price Tuesday $167.855 million of rental housing bonds, 2023 Series F, non-AMT, serials 2026-2035, terms, 2038, 2043, 2048, 2053, 2058, 2063, 2067. Raymond James & Associates.

The Indianapolis Local Public Improvement Bond Bank (Aaa//AAA/) is set to price $155 million of ad valorem property tax funded project revenue bonds. BofA Securities.

The San Diego Unified School District is set to price Tuesday $145.515 million consisting of $2.990 series N-1 taxable green GOs (Aa2///), $97.01 million of Series N-2 green GOs (Aa2//AAA/AAA), $3.255 million of Series R-6 GO refunding bonds(Aa2//AAA/AAA) and $45.26 Series SR-3A refunding bonds (Aa2//AAA/AAA). Jefferies LLC.

The South Dakota Housing Development Authority (Aaa/AAA//) is set to price Wednesday $145 million of homeownership mortgage bonds, consisting of $105 million of non-AMT Series 2023G, serials 2024-2035, terms 2038, 2043, 2049, 2055, and $40 million of taxable Series 2023H, serials 2024-2033, terms 2038, 2040, 2054. Wells Fargo Bank, N.A. Municipal Finance Group.

The Maine Health & Higher Educational Facilities Authority (/AA//) is set to price Wednesday $124.72 million of revenue refunding bonds insured by Assured Guaranty Municipal Corp. Morgan Stanley & Co. LLC.

The New York City HOusing Development Corp. (Aa2/AA+//) is set to price Wednesday $121.5 million of multi-family housing revenue bonds 2023 Series D term rate sustainable development bonds, serial 2063. Citigroup Global Markets Inc.

Ohio (Aa1//AAA/AAA) is set to price Tuesday $121.18 million of general obligation highway capital improvement bonds, Series Y, serials 2025-2039. Loop Capital Markets.

The Missouri Housing Development Commission (/AA+//) is set to price Tuesday $120 million of single-family mortgage revenue bonds (First Place Homeownership Loan Program) Series 2023 E non-AMT, serials 2024-2035, terms 2038, 2043, 2048, 2053, 2054. Stifel, Nicolaus & Company, Inc.

The Successor Agency to the Redevelopment Agency Community Facilities District No. 6, City and County of San Francisco, (/AA//) is set to price Tuesday $119.86 million of Mission Bay South Public Improvements special tax refunding bonds, Series 2023, insured by Assured Guaranty Municipal Corp., serials 2024-2043. Stifel, Nicolaus & Company, Inc.

The Rome Building Authority, Georgia, (Aa1/AA+//) is set to price $102 million of revenue bonds (Rome City Schools Project), Series 2023, insured by Georgia State Aid Intercept Program, serials 2025-2044. Raymond James & Associates, Inc.

The City of Cape Coral, Florida (A1//A+/) is set to price Wednesday $100 million of water and sewer revenue bonds, Series 2023. Morgan Stanley & Co. LLC.

Competitive

The Missouri Highways and Transportation Commission (Aa1/AA+/AA+/) is set to sell $381.610 million of State Appropriations Mega Projects state road bonds, Series A 2023, at 11 a.m. eastern Tuesday.

Primary on Wednesday

J.P. Morgan priced for the Utility Debt Securitization Authority (Aaa/AAA//) $797.015 million of restructuring bonds, Series 2023TE. The first tranche, $661.500 million of tax-exempt bonds, Series 2023TE-1, with 5s of 6/2026 at 3.35%, 5s of 6/2028 at 3.27%, 5s of 12/2028 at 3.27%, 5s of 6/2033 at 3.43%, 5s of 12/2033 at 3.43%, 5s of 12/2039 at 3.98% and 5s of 12/2041 at 4.13%, callable 6/15/2034.

The second tranche, $135.515 million of tax-exempt green bonds, Series 2023TE-2, saw 5s of 12/2036 at 3.72%, 5s of 12/2038 at 3.96%, 5s of 12/2043 at 4.33%, 5s of 12/2050 at 4.50% and 5s of 6/2053 at 4.53%, callable 6/15/2034.

Ramirez & Co. priced for Denver (A1/A+/A+/) $586.835 million of airport system subordinate revenue bonds on behalf of its Department of Aviation. The first tranche, $316.050 million of non-AMT bonds, Series 2023A, saw 5s of 11/2024 at 3.52%, 5s of 2028 at 3.33%, 5s of 2033 at 3.46%, 5s of 2038 at 3.97% and 5s of 2043 at 4.31%, callable 11/15/2033.

The second tranche, $270.785 million of AMT bonds, Series 2023B, saw 5s of 11/2024 at 4.27%, 5s of 2028 at 4.12%, 5s of 2033 at 4.20%, 5s of 2038 at 4.54% and 5s of 2043 at 4.73%, callable 11/15/2033.