Munis were slightly firmer in light secondary trading to start the week, while U.S. Treasuries were weaker and equities ended the trading session up.

The two-year muni-to-Treasury ratio Monday was at 69%, the three-year at 69%, the five-year at 70%, the 10-year at 71% and the 30-year at 90%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 71%, the three-year at 72%, the five-year at 71%, the 10-year at 72% and the 30-year at 90% at 4 p.m.

November is off to “a good start as yields have dropped for the first days of the month and have dropped five consecutive days for the first time since June of this year,” said Jason Wong, vice president of municipals at AmeriVet Securities.

This is good news for munis, which have “posted a total-negative return loss for three straight months,” he noted.

November is usually a positive month for munis, he said, and given the current backdrop, this month should not be an exception.

“With supply continuing to fall short of demand, investors will be in tax-loss-swapping mode coupled with the markets being oversold and investors having cash to invest, we do expect November to have positive returns,” Wong said.

Munis rallied last week, following UST gains “due to investors reacting to the Fed leaving rates unchanged last week,” he said.

The 10-year muni fell 27.3 basis points to end the week at 3.37%, he noted.

“Yields hit their highest mark in 15 years earlier in the week before rallying due to the Fed showing signs of being done with rate hikes,” Wong said.

Due to the rally, munis outperformed UST as “10-year notes are yielding 73.73% compared to 75.35% a week ago, and 74.46% a month ago,” he said.

Secondary trading for the week was a little over $58.27 billion with 55% of all secondary trades being dealer sells, he said.

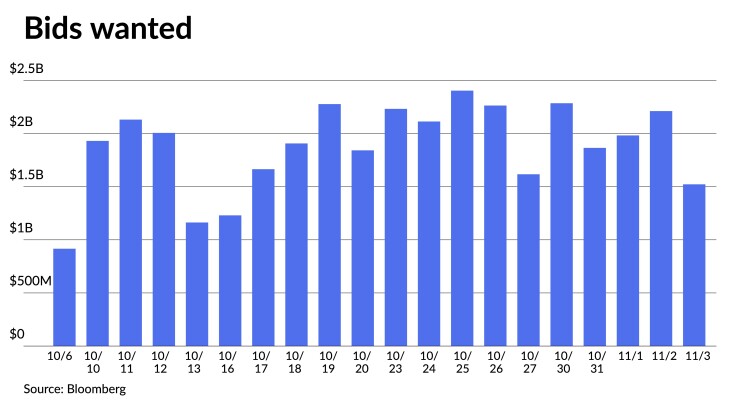

Coming off a week of a record number of bids-wanted, Wong said “clients this past week put up roughly $9.812 billion up for the bid.”

Investors continued to pull money from muni mutual funds, with LSEG Lipper reporting outflows of $1.493 billion after $934.7 billion of outflows the week prior. This makes nine consecutive weeks of outflows.

“Although muni bond funds are seeing outflows, we are seeing an increase of inflows into muni [exchange-traded funds] as last month we saw a record inflow of $2.5 billion as higher yields are enticing buyers due to cheaper beta and tax-exempt exposure,” Wong said.

In the primary market Monday, Wells Fargo Banks priced for the University of Pittsburgh (Aa1/AA+//) $275 million of Commonwealth System of Higher Education university capital project bonds, Series A of 2023, with 5s of 2/3034 at 3.54%, callable 1/15/2034.

October recap

Tax-exempts sold off in October, with the Refinitiv MMD curve cut by an average of 20 basis points, said Peter Block, managing director of credit strategy for Ramirez & Co.

This selloff was “mostly in sympathy with Treasuries but also affected by weaker technical factors,” including curve inversion through around 13-year, negative year-to-date returns, a burst of October supply at $37.156 billion and retail fund outflows at $5 billion,” he said.

To start November, munis rallied with the Refinitiv MMD curve bumped by an average of 22 basis points during the first three days of the month, he noted.

Munis are “generally fairly valued heading into [yearend] with pockets of strong value, including taxables,” he said.

New issues were priced in an “orderly fashion” in October and “buyers still engaged particularly with defensive coupon structures and/or yield concessions,” Block said.

While total volume through Oct. 31 is only at $316.912 billion, down 8.2% year-over-year, Block expects $20 billion of issuance in November and $24 billion in December for a combined total of $44 billion.

Net supply in November and December should be negative-$15 billion, a positive tailwind for the market, he said.

In 2024, Block forecasts $375 billion of long-term issuance in 2024, “mostly driven by incrementally higher new-money tax-exempts,” he said.

Fund outflows accelerated to negative $5 billion in October, the highest of the year, are negative $13.1 billion year-to-date as “rate volatility and negative returns weighed on the market,” he said.

Secondary activity was “manageable” despite a 30% increase in bid wanteds in October as fund outflows intensified, according to Block.

“Trading throughput was orderly and 120% of average levels in October in response to outflows and [bid wanteds],” he said.

Secondary trading

California 5s of 2024 at 3.44%-3.27%. Washington 5s of 2025 at 3.54%. North Carolina 5s of 2025 at 3.39% versus 3.56%-3.53% Thursday and 3.67%-3.69% on 10/26.

Ohio 5s of 2028 at 3.30%. NYC 5s of 2029 at 3.38%. Maryland 5s of 2030 at 3.27%-3.26% versus 3.60% on 10/25.

Charlotte 5s of 2033 at 3.34%-3.30% versus 3.64% original on 10/20. Washington 5s of 2033 at 3.40% versus 3.42% Friday. University of California 5s of 2034 at 3.20% versus 3.52%-3.48% on 10/23.

Massachusetts 5s of 2048 at 4.59% versus 4.68% Thursday and 4.84% on 10/26. NYC 5s of 2051 at 4.67%-4.51% versus 4.70% Friday and 5.05%-5.04% on 10/27.

AAA scales

Refinitiv MMD’s scale was bumped up to two basis points: The one-year was at 3.50% (-2) and 3.39% (-2) in two years. The five-year was at 3.23% (-2), the 10-year at 3.32% (unch) and the 30-year at 4.33% (unch) at 3 p.m.

The ICE AAA yield curve was bumped up to three basis points: 3.50% (-2) in 2024 and 3.47% (-3) in 2025. The five-year was at 3.22% (-2), the 10-year was at 3.30% (-1) and the 30-year was at 4.30% (-1) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped up to two basis points: The one-year was at 3.52% (-2) in 2024 and 3.42% (-2) in 2025. The five-year was at 3.27% (-2), the 10-year was at 3.33% (unch) and the 30-year yield was at 4.33% (unch), according to a 3 p.m. read.

Bloomberg BVAL was cut bumped up to two basis points: 3.54% (-2) in 2024 and 3.47% (-2) in 2025. The five-year at 3.25% (-2), the 10-year at 3.34% (-1) and the 30-year at 4.32% (unch) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.933% (+10), the three-year was at 4.729% (+10), the five-year at 4.596% (+10), the 10-year at 4.648% (+8), the 20-year at 4.995% (+5) and the 30-year Treasury was yielding 4.813% (+5) at the close.

Primary to come

The Salt River Project Agricultural Improvement and Power District, Arizona, (Aa1/AA+//) is set to price Wednesday $650 million of electric system revenue bonds, Series 2023B. Morgan Stanley & Co.

The Black Belt Energy Gas District, Alabama, (A2///) is set to price $432.9 million of gas project revenue bonds, Series 2023 C. Goldman Sachs & Co.

The Massachusetts Clean Water Trust (Aaa/AAA/AAA/) is set to price Wednesday $404.460 million of state revolving fund bonds, consisting of $148.965 million of green Series 25A bonds, serials 2025-2040; $114.58 million of Series 25B sustainability bonds, serials 2036-2044; and $140.915 million of state revolving fund refunding green bonds, Series 2023, serials 2025-2038. Citigroup Global Markets.

The Community Development Administration of the Maryland Department of Housing and Community Development (Aa1//AA+/) is set to price Wednesday $400 million of residential revenue bonds consisting of $75 million of non-AMT social bonds and $325 million of taxable social bonds. J.P. Morgan Securities.

The University of Connecticut (Aa3/AA-/AA-/) is set to price Wednesday $356.73 million of general obligation bonds consisting of $227.415 million of Series A and $129.315 million of refunding bonds. J.P. Morgan Securities.

The California Infrastructure and Economic Development Bank (Aaa/AAA//) is set to price Tuesday $327.61 million of refunding revenue bonds (The J. Paul Getty Trust), Series 2023, consisting of $181.155 million of Series 2023A, serials 2024-2027, 2029-2032, terms 2028, 2033; and $146.455 million of Series 2023B, terms 2047. Jefferies.

The Westchester County Local Development Corp. (/AA//AA+) is set to price Thursday $298.47 million of revenue bonds (Westchester Medical Center Obligated Group Project) insured by Assured Guaranty Municipal Corp. Serials 2031-2034, 2050, terms 2048, 2053. BofA Securities.

The Texas Private Activity Bond Surface Transportation Corp. (Baa1//BBB+/) is set to price Tuesday $268.39 million of senior lien revenue refunding bonds (NTE Mobility Partners Segments 3 LLC). Barclays.

Miami (Aa2/AA//) is set to price Wednesday $250.67 million of special obligation non-ad valorem revenue bonds, Series 2023A. Jefferies.

The North Carolina Housing Finance Agency (Aa1/AA+//) is set to price Wednesday $235 million of home ownership non-AMT social revenue bonds, Series 52-A (1998 Trust Agreement), serials 2025-2035, terms 2038, 2043, 2046, 2055. BofA Securities.

The University of Pittsburgh (Aa1/AA+//) is set to price $189 million of Pitt Asset Notes Tax-Exempt Higher Education Registered Series of 2023, serials 2029. Barclays.

The Oakland Unified School District (A1///) is set to price Thursday $192.08 million of general obligation bonds and GO refunding bonds. Siebert Williams Shank & Co.

The Dripping Springs Independent School District, Texas, (/AAA//) is set to price Thursday $175.4 million of unlimited tax school building and refunding bonds. Permanent School Fund Guarantee Program, serials 2024-2053. Raymond James & Associates.

The Illinois Housing Development Authority (Aaa///) is set to price Tuesday $129.525 million of non-AMT social bonds, serials, 2025-2035, terms, 2039, 2053. BofA Securities.

The Colorado Housing and Finance Authority (Aaa/AAA//) is set to price $126.96 million of single-family taxable mortgage bonds, serials 2026-2033, terms, 2038, 2041, 2053. RBC Capital Markets.

The California Educational Facilities Authority (/BBB-//) is set to price $110 million of Saint Mary’s College of California refunding revenue bonds, serials 2030-2038, terms 2044, 2053. Wells Fargo Bank.

Competitive:

Mesa, Arizona, (Aa3/A+//) is set to sell $195.325 million of utility system revenue obligation bonds, Series 2023, at 12 p.m. eastern Tuesday.

California (Aa2/AA-/AA/) is set to sell $373.130 million of various purpose general obligation refunding bonds, Bidding Group A, at 10:45 a.m. Tuesday and $325.325 million of various purpose general obligation refunding bonds, Bidding Group B, at 11:30 a.m. Tuesday.

Washington (Aaa/AA+/AA+/) is set to sell $296.550 million of various purpose general obligation refunding bonds, Series R-2024A, 10:30 a.m. Tuesday and $186.225 million of motor vehicle fuel tax and vehicle-related fees general obligation refunding bonds, Series R-2024B, at 11 a.m. Tuesday.