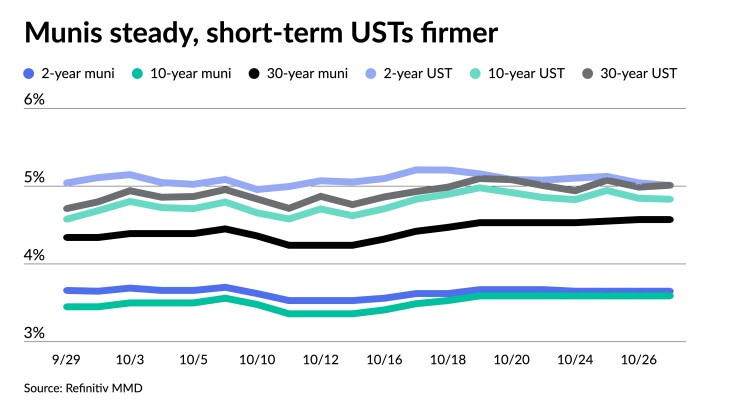

Municipals were steady Friday ahead of an expected paltry new-issue calendar. U.S. Treasuries were firmer 10 years and in and equities were mixed after a volatile week of market-moving economic data and increasing geopolitical tensions in the Middle East while all markets await the Federal Open Market Committee’s November meeting.

“Any chance of a dovish hold by the Fed went out the window after core PCE posted its largest gain in four months,” noted Edward Moya, senior market analyst at OANDA. “Despite another round of robust U.S. economic data (spending and PCE deflator), Treasury yields remain anchored as the Middle East conflict widens.”

Aside from the FOMC, Moya added that Wednesday’s Treasury release of its near-term plans for note and bond sales “could be the trigger that lets yields either surge or plunge below the 5.00% level.”

After reaching their peak and the 10-year briefly hitting 5%, USTs fell on the short end and belly of the curve Friday, “although the rates market is still extremely volatile, with 10bp+ up and down daily moves remaining a norm,” Barclays PLC noted in a weekly report.

Munis, though, did not move much this week, only a few basis points firmer or weaker on a given day, a BofA Global Research report said Friday. The technical posture for muni rates is better than Treasuries, they said.

If Treasury rates become “more stabilized,” it provides “a good reason to be somewhat constructive on munis for a while,” they added.

BofA strategists said it is important to note that even with the higher rate environment, “issuance in October has been strong and daily secondary market volumes have been normal except for one day early in the month.”

Municipal to UST ratios “largely moved sideways, even though for a moment it felt that there was some real buying by investors in the early part of the week,” Barclays strategists said.

The two-year muni-to-Treasury ratio Friday was at 73%, the three-year was at 73%, the five-year at 73%, the 10-year at 74% and the 30-year at 91%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 73%, the three-year at 74%, the five-year at 73%, the 10-year at 74% and the 30-year at 91% at 4 p.m.

Barclays strategists are still “positive on the prospects of the muni market for the remainder of the year.”

While investors continued to pull money from muni mutual funds with LSEG Lipper reporting $934.7 million of outflows, “this week’s relatively low outflow print, coming on the back of last week’s below average number is yet another indication that investors are getting more sanguine on the prospects of the muni market,” Barclays strategists said.

Moreover, after several “very heavy issuance weeks,” they said. The Bond Buyer 30-day visible is at $7.6 billion.

Issuance for the coming week is expected to be “extremely light,” unsurprising during Federal Open Market Committee meeting weeks, they said.

In the weeks to follow the FOMC meeting, there will only be “a handful of active weeks” for the rest of the year, they noted.

“In general, we are clearly not out of the woods as of yet, but there should be some upside from current levels in absolute and relative terms,” Barclays strategists said.

Meanwhile, they said “taxable muni spreads continue trading in narrow trading ranges, even after corporate spreads widened earlier this month.”

Spreads are tight, in part, due to “anemic issuance” and will likely remain tight for the foreseeable future, they said.

Aside from being negative on taxable municipal valuations, Barclays strategists feel that “the longer-dated part of the market is especially rich and there is more value in the intermediate part of the curve.”

New-issue calendar

The new-issue muni calendar is estimated at $2.270 billion next week with $1.834 billion of negotiated deals on tap and $436.3 million on the competitive calendar, according to Ipreo and The Bond Buyer.

The Connecticut Housing Finance Authority leads the negotiated calendar with $190 million of housing mortgage finance program bonds, followed by $172 of senior lien special tax revenue bonds from Dallas and $162 million of green refunding revenue bonds from the Southern California Public Power Authority.

The competitive calendar is led by $94 million of GOs from the Charleston County School District, Southern California.

Secondary trading

LA DWP 5s of 2024 at 3.56% versus 3.56% on 10/19 and 3.46% on 10/13. California 5s of 2024 at 3.68%. DC 5s of 2025 at 3.78% versus 3.83% Thursday.

DASNY 5s of 2028 at 3.70%-3.68%. King County, Washington, 5s of 2029 at 3.57% versus 3.65% original on Thursday. Montgomery County, Maryland, 5s of 2030 at 3.61%.

Maryland 5s of 2032 at 3.63%. King County, Washington, 5s of 2033 at 3.74%. California 5s of 2034 at 3.80%-3.76% versus 3.79%-3.80% Tuesday and 3.79% Monday.

Massachusetts 5s of 2048 at 4.81% versus 4.83% Wednesday and 4.82%-4.78% Tuesday. NYC 5s of 2051 at 5.05%-5.04% versus 5.07% Thursday and 5.06%-4.93% Wednesday.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.76% and 3.65% in two years. The five-year was at 3.49%, the 10-year at 3.59% and the 30-year at 4.57% at 3 p.m.

The ICE AAA yield curve was unchanged: 3.73% in 2024 and 3.70% in 2025. The five-year was at 3.53%, the 10-year was at 3.57% and the 30-year was at 4.55% at 4 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.79% in 2024 and 3.69% in 2025. The five-year was at 3.54%, the 10-year was at 3.60% and the 30-year yield was at 4.58%, according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 3.80% in 2024 and 3.74% in 2025. The five-year at 3.53%, the 10-year at 3.63% and the 30-year at 4.59% at 4 p.m.

Treasuries were firmer 10 years and in.

The two-year UST was yielding 5.007% (-3), the three-year was at 4.841% (-4), the five-year at 4.761% (-3), the 10-year at 4.831% (-1), the 20-year at 5.201% (flat) and the 30-year Treasury was yielding 5.011% (+2) near the close.

Primary to come

The Connecticut Housing Finance Authority (Aaa/AAA//) is set to price Wednesday $189.780 million of social housing mortgage finance program bonds, 2023 Series D, serials 2024-2035, terms 2038, 2043, 2048, 2051 and 2054. RBC Capital Markets

Dallas (/A-//) is set to price Tuesday $171.600 million of Kay Bailey Hutchison Convention Center Dallas Venue Project senior lien special tax revenue bonds, Series 2023, serial 2053. Ramirez & Co.

The Southern California Public Power Authority (Aa2//AA-/) is set to price Tuesday $162.100 million of green Windy Point/Windy Flats Project refunding revenue bonds, Series 2023-1. J.P. Morgan.

The Avon Community School Building Corp. (/AA+//) is set to price Thursday $150 million of ad valorem property tax first mortgage bonds, Series 2023, serials 2027-2043. Stifel, Nicolaus & Co.

The Rhode Island Housing and Mortgage Finance Corp. (Aa1/AA+//) is set to price Tuesday $149.845 million of homeownership opportunity bonds, consisting of $83.305 million of non-AMT social bonds, Series 81-A; $40.535 million of taxable social bonds, Series 81-T-1; and $26.005 million of taxables, Series 81-T-2. Morgan Stanley.

The Colorado State University System Board of Governors is set to price Tuesday $128.765 million of new-issue and refunding system enterprise revenue bonds, consisting of $56.495 million of Series 23-A1 (Aa3/A+//), serials 2024-2041; $60 million of Series 23-A2 (Aa3/A+//), terms 2048 and 2053; $4.710 million of Series 23-B1 (Aa2/AA//), serials 2029-2030, 2033-2037, 2039 and 2042-2043; and $7.560 million of Series 23-B2 (Aa3/A+//), serials 2031-2036 and 2040-2043, terms 2048 and 2051. BofA Securities.

Competitive

The Charleston County School District is set to sell $93.690 million of GOs, Series 2023B, at 11 a.m. eastern Tuesday.