Municipals were mixed Thursday, outperforming U.S. Treasuries, which saw larger losses following a higher-than-anticipated inflation report, while more outflows from muni mutual funds were reported.

U.S. Treasuries sold off after the consumer price index report showed inflation rising, paring back gains after several sessions of a flight-to-safety bid amid the violence in Israel. Equities ended down as the CPI figures further complicated market participant expectations on Federal Reserve policy decisions going forward.

Triple-A yields were little changed or slightly weaker, depending on the curve, while USTs saw the largest losses out long.

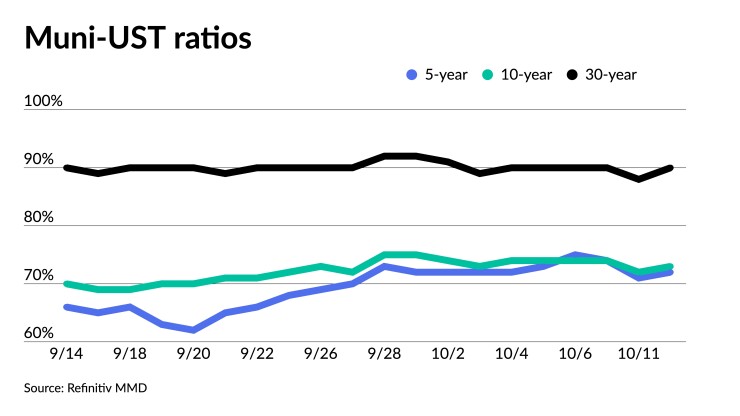

Ratios fell as a result. The two-year muni-to-Treasury ratio Thursday was at 70%, the three-year was at 70%, the five-year at 70%, the 10-year at 71% and the 30-year at 87%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 71%, the three-year at 73%, the five-year at 72%, the 10-year at 73% and the 30-year at 90% at 4 p.m.

September’s consumer price index pointing to price pressures that “continue to warrant restrictive monetary policy,” resulted in “jumps in [U.S. Treasury] bond yields across the curve,” said José Torres, senior economist at Interactive Brokers.

The moves in USTs are “effectively stalling equity bulls who depend on Fed dovishness for two primary reasons,” he said.

For one, “monetary policy accommodation will propel company revenues by taking pressure off of consumer spending and overall interest expenses,” Torres said.

Additionally, lower rates “will make equity valuation metrics look much more attractive relative to fixed-income alternatives.”

The Fed “wants to see ‘target consistent monthly inflation,’ which is somewhere around 0.2%,” said Jeffrey Cleveland, chief economist at Payden & Rygel.

As such, he said “the Fed needs to see a sustained decline in goods prices and a slowdown in services prices.”

Is it “too soon to declare victory over inflation here, especially when most of what you spend your money on are services,” Cleveland said.

This does not mean the Fed will hike rates in November, but the Q3 GDP and nonfarm payrolls having accelerated in the third quarter, will lead to an “interesting debate” at the November Federal Open Market Committee meeting.

The “bigger story” for the bond market, though, is the recent rise in longer-term rates, according to Cleveland.

The combination of better-than-expected growth, the Fed’s “higher for longer” stance, Powell’s quantitative tightening comments at the September press conference, Treasury supply, and investor positioning “explains the move up in rates in recent weeks/months,” he said.

Based on this backdrop, the move up in the long end makes sense.

For munis, “investor conviction remains elusive,” said Tom Kozlik, managing director and head of public policy and management at Hilltop Securities.

Conviction for municipal bond investing “should be stronger considering the market dynamic and very strong credit quality,” he said.

However, the market is instead seeing “some investment dollars have flowed toward short-term options containing variable rates in response to uncertainty and volatility,” he said.

There have been outflows from muni mutual funds for 10 of the last 10 weeks, according to ICI.

LSEG Lipper data Thursday had outflows at $780 million of outflows from municipal bond mutual funds for the week ending Wednesday.

There have been “massively impactful developments have occurred in the last 24 or so months and have been challenging for investors to navigate,” he said.

The investment backdrop “changed again over this past weekend when attacks in the Middle East increased geopolitical tensions,” Kozlik noted.

The possibility of “additional military activity in the region hangs over the data-dependent Federal Reserve now, and it is possible the Fed continues its pause during its November and possibly even during its December 2023 meeting(s),” he said.

He said “municipal bond investments, especially those of the highest credit quality, participated in the flight-to-quality trading activity in the wake of the events … that caused the highest level of market uncertainty over the last almost two years.”

“After the military attacks and the banking sector stress especially we saw and agree investors should be viewing municipals as a primary fixed-income option,” he said.

At the start of the summer, Kozlik noted that muni yields were historically attractive and “investors should be taking notice of the U.S. municipal bond market opening.”

More recently, prior to the September FOMC meeting, he noted municipal yields were peaking to end the third quarter.

Since the Fed announced it was pausing to reassess the economic situation, muni yields rose 40 basis points, according to Kozlik.

Muni yields were firmer on Tuesday and Wednesday, falling 17 to 22 basis points, according to Refinitiv MMD.

However, Kozlik said “the fact that market forces were able to increase yields without the Fed acting in September is being heavily considered by some market observers as a signal that future Federal Reserve action could be limited.”

Fed watching, he said, “remains the primary focus of most investment markets, including the municipal market.”

He believes muni investors should not try to time the market, though munis are at “generationally enticing levels.”

Compared to last week, the Fed is less likely to “continue its crusade higher now.”

“Future investment opportunities as attractive as this for municipal investors may occur, but the opportunities will be less frequent,” he noted.

In the competitive market Thursday, The Louisville/Jefferson County Sewer District, Kentucky (Aa3/AA//) sold $351.975 million of sewer and drainage revenue bonds, Series 2023C, to BofA Securities, with 5s of 5/2024 at 3.65%, 5s of 2028 at 3.44%, 5s of 2033 at 3.51%, 5s of 2038 at 4.04%, 5s of 2043 at 4.29%, 5s of 2048 at 4.60% and 5s of 2053 at 4.64%, callable 11/15/2033.

Secondary trading

Florida 5s of 2024 at 3.85% versus 3.76%-3.75% on 10/2. Triborough Bridge and Tunnel Authority 5s of 2024 at 3.79%. Maryland 5s of 2025 at 3.69%.

NYC TFA 5s of 2028 at 3.49%. Massachusetts 5s of 2029 at 3.31%. Wisconsin 5s of 2029 at 3.38% versus 3.63%-3.59% on 10/3.

California 5s of 2031 at 3.40%-3.42%. NY Dorm PIT 5s of 2032 at 3.50%. Massachusetts 5s of 2033 at 3.37%.

Washington 5s of 2048 at 4.40%-4.50% versus 4.47% Wednesday. NYC TFA 5s of 2053 at 4.69%-4.68% versus 4.80% on 10/2.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.61% and 3.53% in two years. The five-year was at 3.29%, the 10-year at 3.36% and the 30-year at 4.24% at 3 p.m.

The ICE AAA yield curve was cut two to three basis points: 3.62% (+2) in 2024 and 3.57% (+3) in 2025. The five-year was at 3.32% (+2), the 10-year was at 3.36% (+2) and the 30-year was at 4.26% (+2) at 4 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.64% in 2024 and 3.56% in 2025. The five-year was at 3.33%, the 10-year was at 3.37% and the 30-year yield was at 4.25%, according to a 3 p.m. read.

Bloomberg BVAL was cut one to five basis points: 3.63% (+1) in 2024 and 3.57% (+3) in 2025. The five-year at 3.32% (+4),the 10-year at 3.39% (+4) and the 30-year at 4.32% (+5) at 4 p.m.

Treasuries sold off.

The two-year UST was yielding 5.068% (+7), the three-year was at 4.847% (+9), the five-year at 4.697% (+12), the 10-year at 4.706% (+13), the 20-year at 5.068% (+15) and the 30-year Treasury was yielding 4.868% (+15) near the close.

CPI report

The September CPI “put a halt to what had been a string of cooler inflation data through the summer and reaffirms our view that the disinflationary process is likely to be bumpy and nonlinear,” said Mickey Levy, chief economist for Americas and Asia at Berenberg Capital Markets, a member of the Shadow Open Market Committee.

September’s CPI “demonstrates that progress in lowering inflation ahead is likely to prove slower going than it has been over the past year,” said Wells Fargo Securities Senior Economists Sarah House and Michael Pugliese.

However, they noted “the downward trend remains in place … with the core CPI set to recede further over the coming year as shelter disinflation resumes, supply-related pressures ease and consumers grow more price sensitive.”

A “mixed report leaves the Fed hanging,” said Giuseppe Sette, president of Toggle AI.

The CPI print rose “a tad more” than anticipated, but core CPI did the opposite, he noted.

Core inflation has steadily ticked higher over the last three months, said Olu Sonola, Fitch Ratings head of US economics. Furthermore, it is “still double the Fed’s target and proving to be incredibly stubborn,” said Jay Hawkins, senior economist at BMO Economics.

Meanwhile, the robust increases in ‘supercore’ prices across August and September will “likely reaffirm the prevailing view among Fed officials that inflation risks remain skewed to the upside and push Fed members to continue to assert that rates will need to remain higher for longer,” Levy said.

Market participants differed on whether the CPI report changes the Fed’s trajectory for the remainder of the year.

Some believe another rate hike is still on the table.

The September CPI print was “strong on the services side and this print, along with the strong September payroll print, meets the bar we previously set for an additional hike in November — with the important exception of easing financial conditions, which remain more than one 25bp hike tighter since the September FOMC meeting,” said Morgan Stanley Research strategists.

And given the “stickiness of the core inflation figure,” the possibility of the Fed hiking rates one more time is still in “play,” said Tom Hopkins, portfolio manager at BRI Wealth Management.

“The last mile that will get inflation to 2% will be tough especially as labor markets remain tight,” he said. “This is why the Fed will remain restrictive for quite some time.”

Others thought the Fed won’t hike rates again this year.

Despite the slight acceleration in overall consumer price inflation in September, the details of the report aren’t enough to prompt the Fed to hike again,” Hawkins said.

The “most likely course of action for the Fed is no further tightening, but for rates to remain higher-for-longer to ensure that inflation approaches its 2% target,” he said.

However, Morgan Stanley Research strategists noted “the Fed voices that have argued for no further hike this year will maintain that view as long as financial conditions remain tighter.”

“But the recent set of data make the next round even more important in the December hike determination for policymakers,” they said, noting December remains a “live meeting.”

Sonola, though, argued the Fed may opt to extend the pause to December, given the recent increase in long-term rates.

Whatever the Fed’s next move will be, most think the Fed is approaching the end of its hiking cycle.

Thursday’s data “supports being close to the end of the hiking cycle as the U.S. economy remains on a disinflation path, which has been supported by recent Fed speak and the recent tightening in financial conditions,” said Lindsay Rosner, head of Multi-Sector Fixed Income Investing at Goldman Sachs Asset Management.