Transportation and issuer groups have expressed support for a Republican Senate bill that would require electric vehicle owners to pay a fee to help support the struggling Highway Trust Fund.

Senate Bill 2882, the Stop EV Freeloading Act, would impose a $1,000 fee at the manufacturer level and a one-time fee of $550 on each EV battery module weighing more than 1,000 pounds. The money would go to the Highway Trust Fund, which is funded by the fading federal gas tax.

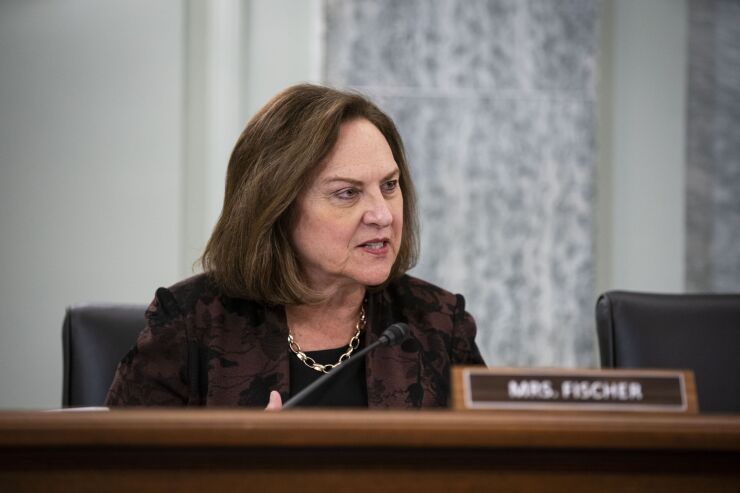

“It’s not fair to force the millions of Americans who don’t drive EVs to foot the bill for those who do,” said bill sponsor Sen. Deb Fischer, R-Neb., who sits on the Senate Commerce, Science and Transportation Committee, in a statement.

“If the Biden administration plans to continue pushing EVs on the American people, the least Congress can do is require EVs to support the upkeep of our nation’s infrastructure.”

Bloomberg

The Highway Trust Fund, which supports more than 90% of formula funds sent to states, faces insolvency by 2027, according to the Congressional Budget Office. That’s despite a $118 billion general fund infusion to the fund under the 2021 Infrastructure Investment and Jobs Act, and previous bailouts. The fund’s main revenue, the federal gas and diesel tax, has not been raised in 30 years and has failed to keep up with the HTF’s programs since 2008. A background sheet on the bill said EVs are heavier than combustion engine vehicles, and extract a heavier toll on roads and bridges.

“The Highway Trust Fund is intended to function as a consistent source of transportation funding and is vital to maintaining our county infrastructure,” said Matthew Chase, executive director of the National Association of Counties, adding that counties own and operate more roads and bridges than any other level of government.

“While we need a long-term fix for the Highway Trust Fund, a user-pay approach continues to be the cornerstone of federal transportation policy where all users of the road pay a fair share.”

David Bauer, president and CEO of the American Road & Transportation Builders Association, said the idea of drivers supporting the highways and bridges they use “has been the foundation of federal surface transportation investment for nearly 70 years,” and that the EV tax bill would restore “integrity and equity to that time-honored practice.”

The transition to electric vehicles is a key energy goal for President Joe Biden, who wants half of all new cars to be electric by 2030. The IIJA allocated $7.5 billion to states and municipalities to build out a national EV charging system. The Inflation Reduction Act offers tax credits of up to $7,500 for qualifying EVs, a subsidy that’s sparked opposition from Republicans who say it undermines the free market and rewards China as one of the top manufacturers of electric batteries.

The National League of Cities, Associated General Contractors of America and American Society of Civil Engineers also support the bill, according to Fischer’s office.

Republican Sen. Pete Ricketts, R-Neb., Sen. John Cornyn, R-Tx., and Sen. Cynthia Lummis, R-Wy., are co-sponsors. The bill was introduced to the Senate Finance Committee. It’s unknown whether it will garner enough support from Democrats to move forward.