Municipals were firmer Tuesday, underperforming a U.S. Treasury flight-to-safety rally. Equities ended in the black.

Triple-A muni yields fell up to 10 basis points while USTs rallied upwards of 15 basis points.

The two-year muni-to-Treasury ratio Tuesday was at 73%, the three-year was at 73%, the five-year at 74%, the 10-year at 75% and the 30-year at 90%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 73%, the three-year at 75%, the five-year at 74%, the 10-year at 74% and the 30-year at 90% at 4 p.m.

Last week “was all about an intensifying bond market selloff,” noted Edward Moya, senior market analyst at OANDA.

However, that selloff appears “to be over following the surprise attack by Hamas on Israel,” Moya said.

The flight-to-safety into bonds is allowing UST yields to ease.

“With the bond market fully reopened, it is clear that Wall Street is betting that the Fed is done,” he said.

However, Moya noted “a long-lasting bond market rally seems unlikely given major structural shifts of higher bond supply and on uncertainty with demand.”

Last week’s muni new-issue calendar “was priced to sell and well received,” though some deals were pulled and others moved to day-to-day pricing due to weak market conditions, said Anders S. Persson, Nuveen’s chief investment officer for global fixed income, and Daniel J. Close, Nuveen’s head of municipals.

This week will see a “muted” new-issue calendar, they said.

Deals that come to market this week will likely need to be “priced at distressed levels to clear the market,” Persson and Close said.

Outflows from muni mutual funds continued last week as LSEG Lipper reported $1.3 billion was pulled “while fears intensified that this year’s negative performance may trigger clients to further pull their cash to stop the bleeding,” Birch Creek strategists said.

Muni mutual fund flows will remain negative for at least several weeks, according to CreditSights strategists Pat Luby and Sam Berzok, as “the sharply lower NAVs will result in a surge of tax-loss selling.”

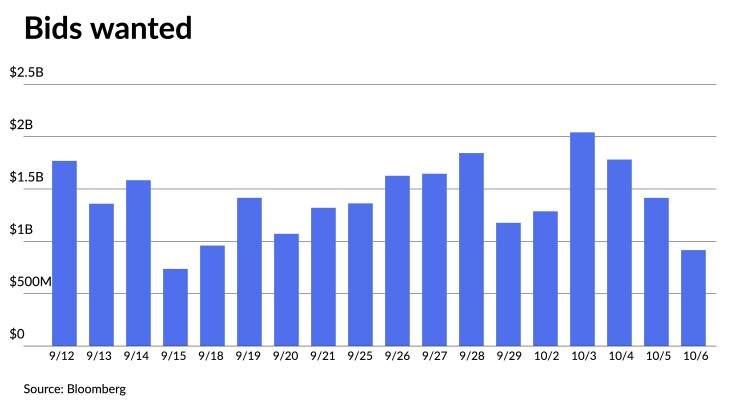

Bids wanteds volume jumped 20% compared to recent averages and overall trading volume surged, Birch Creek strategists said.

Separately managed account “clients with [Oct. 1] cash to reinvest helped keep prices in check, but mounting losses led to a jump in tax swaps which we expect will continue to keep volumes elevated through year-end,” Birch Creek Capital strategists said.

Tuesday saw more than 70,000 trades executed — the largest volume of the year — only to be surpassed by Wednesday’s 80,000-plus trades, which was the second busiest day since the Covid spike in March 2020, they said.

Persson and Close are “bullish on the municipal bond market and expect fixed income investments in general will look attractive by mid-2024.”

They believe investors “should remain allocated to muni bonds and consider implementing tax-loss swaps, as we see opportunities to increase tax-exempt income in portfolios.”

Like USTs, they said the entire muni curve represents value.

Due to heavier supply, Persson and Close expected volatility in the muni market to continue through the end of the year.

Also, they noted, “dealers are reluctant to support the muni market with strong bidding in the secondary market.”

They see any selloffs as a buying opportunity.

In the primary market Tuesday, J.P. Morgan held a one-day retail order for the Triborough Bridge and Tunnel Authority (/AA+/AA+/AA+/) for $943.665 million of MTA Bridges and Tunnels payroll mobility tax senior lien refunding climate-certified green bonds, Series 2023C, with 5s of 11/2031 at 3.79%, 5s of 2033 at 3.88%, 5s of 2038 at 4.43% and 5s of 2041 at 4.61%, callable 11/15/2033.

Secondary trading

Connecticut 5s of 2024 at 3.75% versus 3.86% Thursday. California 4s of 2024 at 3.66%. Maryland 5s of 2025 at 3.66% versus 3.75% Friday.

LA DWP 5s of 2028 at 3.24%. Washington 5s of 2030 at 3.57%. North Carolina 5s of 2030 at 3.41%.

University of California 5s of 2033 at 3.35%-3.33%. Tampa waters, Florida, 5s of 2033 at 3.57%-3.56% versus 3.58%-3.59% Thursday. Dane County, Wisconsin, 5s of 2035 at 3.71%-3.70% versus 3.80% Thursday.

NYC 5s of 2048 at 4.64%-4.65%. San Jose Financing Authority 5s of 2052 at 4.37%-4.36% versus 4.47%-4.46% Wednesday and 4.35% on 9/29.

AAA scales

Refinitiv MMD’s scale was bumped eight to nine basis points: The one-year was at 3.70% (-8) and 3.62% (-8) in two years. The five-year was at 3.41% (-8), the 10-year at 3.48% (-8) and the 30-year at 4.36% (-9) at 3 p.m.

The ICE AAA yield curve was bumped four to seven basis points: 3.67% (-5) in 2024 and 3.62% (-7) in 2025. The five-year was at 3.41% (-5), the 10-year was at 3.44% (-5) and the 30-year was at 4.36% (-4) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped eight to nine basis points: The one-year was at 3.73% (-8) in 2024 and 3.65% (-8) in 2025. The five-year was at 3.45% (-8), the 10-year was at 3.49% (-8) and the 30-year yield was at 4.37% (-9), according to a 3 p.m. read.

Bloomberg BVAL was bumped eight to 10 basis points: 3.71% (-10) in 2024 and 3.64% (-10) in 2025. The five-year at 3.38% (-9), the 10-year at 3.46% (-9) and the 30-year at 4.38% (-10) at 4 p.m.

Treasuries rallied.

The two-year UST was yielding 4.956% (-13), the three-year was at 4.747% (-14), the five-year at 4.608% (-15), the 10-year at 4.656% (-13), the 20-year at 5.034% (-12) and the 30-year Treasury was yielding 4.834% (-12) near the close.

Primary to come:

The Allegheny County Airport Authority, Pennsylvania, (A2//A/A+) is set to price Wednesday $394.215 million of Pittsburgh International Airport AMT revenue bonds, consisting of $366.225 million of Series 2023A, serials 2026-2043, terms 2048, 2053, and $27.99 million of Series 2023B, serials 2026-2043, terms 2048, 2053. Citigroup Global Markets.

The Los Angeles Department of Water and Power (Aa2/AA-//AA) is set to price Thursday $312.39 million of power system revenue refunding bonds, 2023 Series D, serials 2024-2032, 2041-2043. TD Securities.

The Chabot-Las Positas Community College District, California, (Aa2/AA//) is set to price Wednesday $252 million of Alameda and Contra Costa Counties Election of 2016 general obligation refunding bonds, Series C. Morgan Stanley.

Houston (Aa3//AA/) is set to price Wednesday $248.620 million of public improvement and refunding bonds, Series 2023A, serials 2025-2043. Raymond James & Associates.

The School Facilities Improvement District No. 1 of Santa Monica-Malibu Unified School District, California, (Aa1/AA+//) is set to price Wednesday $175 million of general obligation bonds, Election of 2018, Series C, consisting of $162.85 million of exempts, serials 2024-2044, and $12.15 million of taxables, serial 2023. Raymond James & Associates.

The Kentucky State Property and Building Commission (A1//AA-/) is set to price Wednesday $144.125 million of Project No. 128 revenue bonds, Series A, serials 2024-2043. BofA Securities.

The Indiana Housing and Community Development Authority (Aaa//AA+/) is set to price Wednesday $134.67 million of non-AMT and AMT single-family mortgage revenue social bonds, 2023 Series D-1. J.P. Morgan Securities.

Competitive:

Lake Forest Community HSD #115, Illinois, is set to sell $102.49 million of general obligation bonds at 11 a.m. eastern Wednesday.

Jersey City, New Jersey, is set to sell $124.45 million of bond anticipation notes at 11:15 a.m. Wednesday. The issuer will also sell $19.2 million of taxable BANs at 11:30 a.m.

The Louisville/Jefferson County Sewer District, Kentucky, is set to sell $341.94 million of sewer and drainage revenue bonds at 10:30 a.m. Thursday.