New York’s attorney general asked a judge Wednesday for a partial summary judgment against Donald Trump in her $250 million lawsuit accusing the former president of widespread fraud, citing what she called a “mountain of undisputed evidence” of false and misleading financial statements.

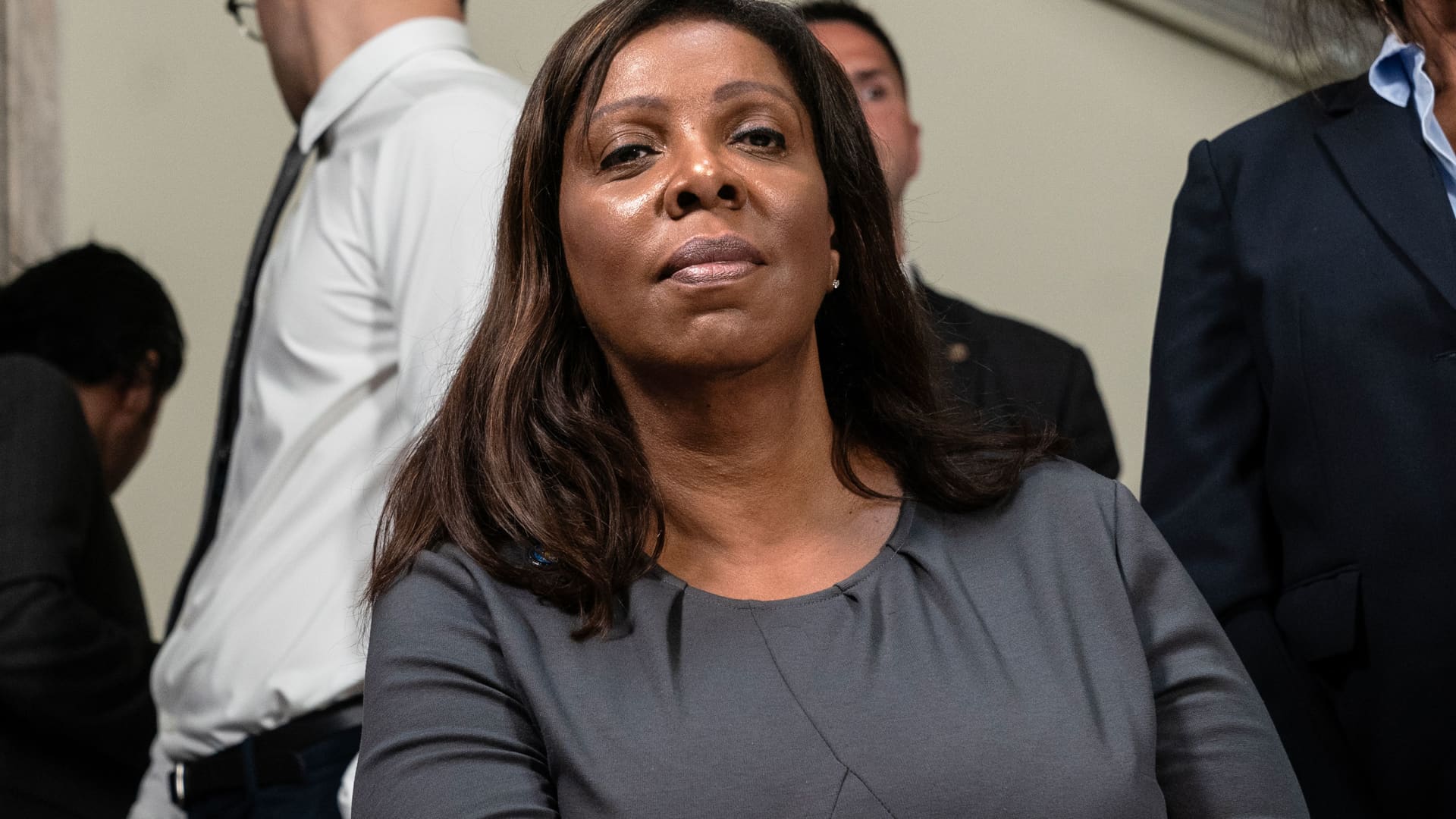

AG Letitia James, in a court filing, said evidence shows that if Trump’s net worth was correctly calculated, it would be between 17% and 39% lower than what he claimed each year over the course of a decade, “which translates to the enormous sum of $1 billion or more in all but one year.”

The allegedly false statements included years when Trump was in the White House, according to the filing.

James’ filing comes two months before the trial is set to begin in the civil suit against the former president, the Trump Organization, and his sons, Donald Trump Jr. and Eric Trump, at New York Supreme Court in Manhattan.

James is suing the Trumps for allegedly defrauding banks, insurance companies and others with the use of false financial statements.

That trial would still take place to address other claims, even if Judge Arthur Engoron grants James’ request for partial summary judgment and finds Trump and other defendants committed fraud under New York business law.

James, in her motion, says Engoron has to answer just “two simple and straightforward questions” to make that finding.

One question is whether Trump’s annual statements of his financial condition were “false or misleading,” the attorney general wrote.

The other question, she wrote, is whether Trump and his co-defendants repeatedly used the financial statements to conduct business transactions.

“The answer to both questions is a resounding ‘yes’ based on the mountain of undisputed evidence cited” in the documentation submitted by James’ office, the motion said.

“Based on the undisputed evidence, no trial is required for the Court to determine that Defendants presented grossly and materially inflated asset values in the SFCs [financial statements] and then used those SFCs repeatedly in business transactions to defraud banks and insurers,” James wrote.

“Notwithstanding Defendants’ horde of 13 experts, at the end of the day this is a documents case, and the documents leave no shred of doubt that Mr. Trump’s SFCs do not even remotely reflect the ‘estimated current value’ of his assets as they would trade between well-informed market participants,” the motion said.

CNBC has requested comment from a lawyer for Trump.