Municipals had a slightly firmer tone Wednesday while U.S. Treasuries were little changed and equities ended up.

Triple-A yields fell one to three basis points, depending on the curve, while UST maintained levels in a subdued session.

While munis underperformed UST Tuesday, “there has been firmness in the muni market throughout the past week,” said Matthew Gastall, executive director and head of Wealth Management Municipal Research and Strategy at Morgan Stanley.

Munis continued to exhibit some strength Wednesday, while USTs were little changed. Wednesday also saw the release of economic data.

“The ADP and revised GDP numbers may attract some attention but they were never likely to have too great an impact,” said Craig Erlam, senior market analyst for UK and EMEA at OANDA. “Today’s data was never likely to be overly impactful with [Thursday’s] inflation, income, and spending figures, prior to Friday’s payrolls, always the primary focus.

“That could well set the tone for September ahead of some major central bank meetings,” he said.

Wednesday’s ADP report came in slightly below expectations, which has led to the return of a bit of a “risk off” trade in the market, he said.

Throughout much of August, he said economic data has surprised to the upside and labor markets have been quite resilient.

“For the most part, we had a ‘risk on’ trade and notable weakness in rates, which has now created a more favorable backdrop for investors,” Gastall said.

As the Labor Day holiday approaches, there is slower activity in the primary market, but Gastall said the “secondary market activity is still healthy for this time of the year, as we approach the end of the month.”

He believes a “significant reason” for this is due to the notable backup in interest rates throughout the month.

“We’ve seen more buyer attention at this time of the year versus what we generally would experience as we approach the beginning of September,” he said.

Seasonally, he said the back end of September is when the primary activity typically begins to accelerate again. Some deals, he said, had been postponed as a result of higher rates.

“There are some issuers who may very well begin to work with the higher nominal rate environment and, hence, may look to issue debt when investor attention is typically strong in the fall,” he said.

“We’re currently in a period where the technicals, specifically for municipals, are still very constructive,” Gastall said.

This week’s calendar is close to $2 billion, and next week’s calendar will likely be “highly manageable” as well.

“So supply is still, for the most part, low in anticipation of the upcoming holiday,” he said.

At the same time, however, the market is still managing the residual impacts of redemption-driven reinvestment demand.

Lower supply and healthy demand are helping ratios to remain “well valued” versus other taxable counterparts.

The two-year muni-to-Treasury ratio Wednesday was at 64%, the three-year at 66%, the five-year at 67%, the 10-year at 71% and the 30-year at 92%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 65%, the three-year at 67%, the five-year at 66%, the 10-year at 70% and the 30-year at 92% at 4 p.m.

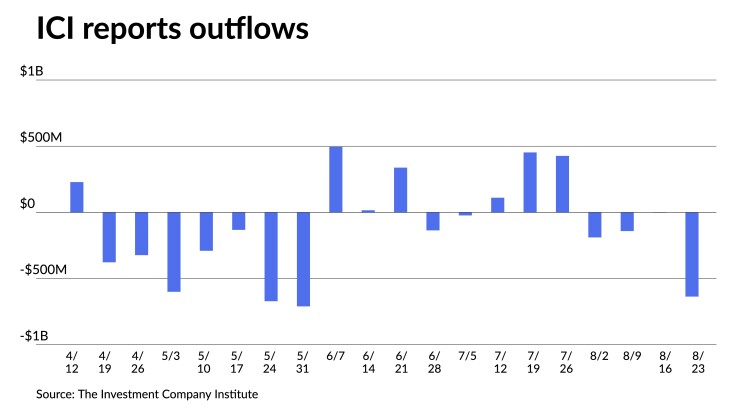

The Investment Company Institute reported investors pulled $636 million from municipal bond mutual funds in the week ending Aug. 23, after $3 million of outflows the previous week. ETFs saw inflows of $21 million after $168 million of outflows the week prior.

In the primary market Wednesday, Wells Fargo Bank priced for Richmond, Virginia (Aa1/AA/AA/), $110.970 million of public utility revenue and refunding bonds, Series 2023C, with 5s of 1/2024 at 3.27%, 5s of 2028 at 2.98%, 5s of 2033 at 3.11%, 5s of 2038 at 3.63%, 4s of 2043 at 4.19%, 5s of 2047 at 4.07% and 4.25s of 2053 at 4.44%, callable 1/15/2034.

August recap

Kim Olsan, senior vice president of municipal bond trading at FHN Financial, said the beginning of the month had munis “still basking in some of July’s reinvestment flows which brought in roughly $37 billion available to rollover against what was $26 billion in new issue supply.”

August’s calls and maturities were around $45 billion but “appear to have been largely spent in July with new issue settlements 15-30 days ahead,” according to Olsan.

On Aug. 1, the 10-year Refinitiv MMD yield was at 2.61%, which was the lowest of the month.

In that first week, the 10-year UST traded above 4%, “reaching a low of 4.01% on Aug. 9 while the MMD yield had sold off 11 basis points in the ensuing week,” she said.

Issuance reflected buyers’ widening bidsides, she said, noting that “a sale of Aaa/AAA Minnesota GOs drew a 10-year maturity spread +13/MMD, 5 basis points wide to its 2023 implied average spread (follow-through trading in the issue was slow to occur as well).”

By mid-August, both munis and USTs continued to weaken, as the 10-year MMD yield rose to 2.75% and the 10-year UST to 4.21%.

During that two-week period, she said dealer muni inventories grew 17% as new issue attrition stalled. “The other compounding effect that gave (and continues) some inquiry temporary cover was a spike in floating-rate yields to over 4%, or nearly 80 basis points above the weekly average this year,” Olsan said.

Last week, she said “munis suffered further price erosion with the 10-year MMD yield spiking 20 basis points along with a new cycle high UST yield of 4.34% (8/21) as economic data results and [Federal Open Market Committee] rate intentions have brought outsized volatility,” she said.

“The after-shocks of Texas volume and the effect on relevant general market spreads has forced a wider range across a broad swath of the market,” Olsan noted.

The 10-year MMD was unchanged Tuesday from the week prior, while the 10-year UST rallied 21 basis points, she said.

In September, she said muni rate volatility is expected to continue but with “credit fundamentals in a strong position, buyers can benefit from both a higher yield set and ratios.”

Secondary trading

California 5s of 2024 at 3.06% versus 3.09% in 8/24. NYC 5s of 2025 at 3.12% versus 3.25% on Monday. Maryland 5s of 2026 at 3.06% versus 3.08% Tuesday.

Washington 5s of 2028 at 2.93%. DC 5s of 2028 at 2.92% versus 2.94%-2.92% Tuesday and 2.77% on 8/16. Tennessee 5s of 2029 at 3.02%.

New Mexico 5s of 2032 at 3.04% versus 3.10% Tuesday. University of California 5s of 2035 at 2.96% versus 3.00% Tuesday and 3.02% Monday. Maryland 5s of 2036 at 3.26%-3.25%.

NYC 5s of 2047 at 4.25%-4.21% versus 4.25% Tuesday and 4.21% Monday. Massachusetts 5s of 2048 at 4.08% versus 4.05%-4.06% on 8/18. Washington 5s of 2048 at 4.06%-4.07% versus 4.13% Tuesday and 4/21% on 8/23.

AAA scales

Refinitiv MMD’s scale was bumped two to three basis points: The one-year was at 3.25% (-2) and 3.14% (-2) in two years. The five-year was at 2.88% (-2), the 10-year at 2.93% (-2) and the 30-year at 3.88% (-3) at 3 p.m.

The ICE AAA yield curve was bumped up to one basis point: 3.27% (-1) in 2024 and 3.20% (-1) in 2025. The five-year was at 2.87% (-1), the 10-year was at 2.86% (unch) and the 30-year was at 3.87% (-1) at 4 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was bumped up two to three basis points: 3.26% (-2) in 2024 and 3.14% (-2) in 2025. The five-year was at 2.89% (-2), the 10-year was at 2.94% (-2) and the 30-year yield was at 3.87% (-3), according to a 4 p.m. read.

Bloomberg BVAL was bumped one to two basis points: 3.24% (-2) in 2024 and 3.15% (-2) in 2025. The five-year at 2.86% (-2), the 10-year at 2.86% (-2) and the 30-year at 3.85% (-2) at 4 p.m.

Treasuries were little changed.

The two-year UST was yielding 4.890% (+1), the three-year was at 4.576% (+1), the five-year at 4.278% (+1), the 10-year at 4.121% (flat), the 20-year at 4.423% (+1) and the 30-year Treasury was yielding 4.230% (+1) near the close.

Competitive:

The South Carolina Association of Government Organization (MIG-1///) is set to sell $230.191 million of certificates of participation (South Carolina School District Credit Enhancement Program) at 11 a.m. eastern Thursday.