Municipals were little changed Friday, once again ignoring losses in the U.S. Treasury and equity markets that were digesting higher-than-expected inflation data and macroeconomic concerns.

While the consumer price index came in nearly as expected on Thursday, Friday’s producer price index came in higher than expected, leaving some analysts to fear more Federal Reserve rate hikes may be possible.

“The disinflation process is going to struggle reaching the Fed’s 2% target,” said Edward Moya, senior market analyst at OANDA. “A slightly hotter-than-expected PPI report sent Treasury yields initially higher as Wall Street started to fret over a potential reacceleration with inflation.”

July final demand PPI climbed 0.3%, which “suggests stubborn inflation pressures remain in the economy,” he added.

Another day of mixed inflation data led Treasury yields to rise but municipals mostly stayed put. Munis had underperformed the UST rally earlier in the week, so the past two days were munis playing catch up, but the market is also focused on the $9 billion of redemption flows coming on Tuesday.

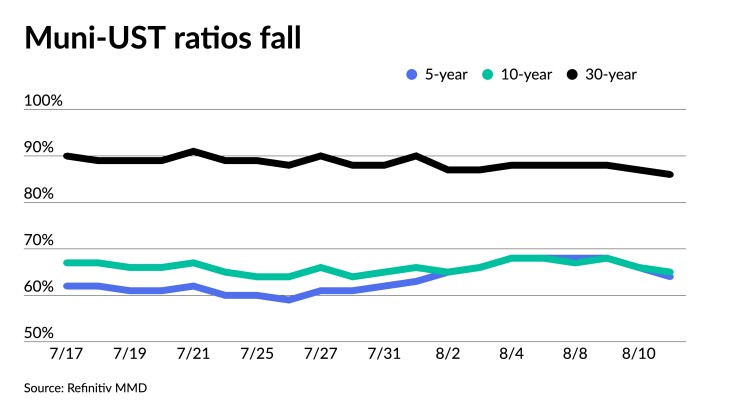

Muni to UST ratios richened again as a result. The two-year muni-to-Treasury ratio Friday was at 63%, the three-year at 64%, the five-year at 64%, the 10-year at 65% and the 30-year at 86%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 64%, the three-year at 65%, the five-year at 64%, the 10-year at 66% and the 30-year at 87% at 4 p.m.

“Although recent data releases have been mostly supportive of the view that inflation is moderating, long-term inflation swaps remain stubbornly elevated, though shorter-term swaps have finally started adjusting lower,” Barclays PLC strategists wrote in a weekly report.

“Affected by the rate selloff, together with the Fitch’s downgrade of the U.S. rating last week and Moody’s downgrade this week of a number of U.S. regional banks, risky markets felt somewhat wobbly and corporate credit spreads widened a bit,” Barclays strategists said.

Not so in the municipal market, they said.

“Municipal spreads continued grinding tighter for some of the high-beta credits, as well as for high-yield,” Barclays said.

In the investment-grade universe, double-A credits were the best performers, outperforming both lower- and higher-rated credits.

Double-A spreads “are getting too rich, in our view, and we prefer reallocating into other maturity buckets; overall lower-dated names could continue to outperform,” Barclays said.

They said taxable muni spreads remain fully valued, but they still see selective opportunities in the space.

“Some of the short- and medium-term bonds are still attractive enough, as the credit curve is very flat,” Barclays said. “Yield buyers should find the 20-year portion attractive, as they can take advantage of the 15-basis-point inversion of the 20- to 30-year UST curve.”

The market tone has improved for munis, “but we are still somewhat cautious.”

“One reason is that supply has remained relatively robust, although it is hardly a surprise, given that August was the third heaviest issuance month after October and June in the past several years,” they said. “Supply this and next week is slower than during the first week of August, but is still heavy enough, and we are likely on track to get close or even surpass $30 billion this month.”

“If rates remain range-bound, new issuance should be easily absorbed, but that might not be the case if volatility continues,” they said.

Calendar ahead led by airport credits

Bond Buyer 30-day visible supply sits at $10.9 billion and of that next week’s volume is estimated at $6.302 billion.

There are $4.644 billion of negotiated deals scheduled while competitive deals total about $1.657 billion.

The calendar for the coming week includes several large airport deals from Dallas-Fort Worth, Atlanta and Chicago’s O’Hare, as the sector’s credit picture continues to improve.

High-grade states, Tennessee and Wisconsin, lead the competitive calendar with GO sales.

Secondary trading Friday

Montgomery County, Maryland, 5s of 2024 at 3.30%. Oregon DOT 5s of 2024 3.29%. New York City 5s of 2024 at 3.27%. California 5s of 2024 at 3.05%.

Prince George’s County, Maryland, 5s of 2025 at 3.18%. Georgia 5s of 2025 at 3.15%. North Carolina 5s of 2025 at 3.11%. North Carolina 5s of 2026 at 3.07%.

Maryland 5s of 2031 at 2.66%. Maryland 5s of 2034 at 2.83%.

Wake County, North Carolina, 5s of 2037 at 3.17%.

California 5s of 2042 3.45%.

Washington 5s of 2048 at 3.98%.

AAA scales

Refinitiv MMD’s scale was left unchanged: The one-year was at 3.26% and 3.10% in two years. The five-year was at 2.77%, the 10-year at 2.70% and the 30-year at 3.69% at 3 p.m.

The ICE AAA yield curve was mixed: 3.26% (-2) in 2024 and 3.12% (-1) in 2025. The five-year was at 2.75% (+1), the 10-year was at 2.69% (+1) and the 30-year was at 3.69% (+1) at 4 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was unchanged: 3.27% in 2024 and 3.10% in 2025. The five-year was at 2.78%, the 10-year was at 2.72% and the 30-year yield was at 3.68%, according to a 4 p.m. read.

Bloomberg BVAL was cut one basis point: 3.20% (+1) in 2024 and 3.09% (+1) in 2025. The five-year at 2.77% (+1), the 10-year at 2.71% (+1) and the 30-year at 3.75% (unch) at 4 p.m.

Treasuries saw losses.

The two-year UST was yielding 4.899% (+8), the three-year was at 4.586% (+11), the five-year at 4.314% (+11), the 10-year at 4.17% (+9), the 20-year at 4.457% (+5) and the 30-year Treasury was yielding 4.274% (+4) at the close.

PPI a game changer?

The PPI data “has caused investors to become less optimistic,” noted José Torres, senior economist at Interactive Brokers, “and they are placing the likelihood of a September pause followed by a November rate increase at roughly 31%.”

The question becomes will businesses try to pass these costs to consumers, and if they do, what will customers do, he said.

“The potentially higher prices would also influence future CPI readings,” Torres added, “which in turn could provide more fodder for hawkish members of the Fed’s Federal Open Market Committee to argue for additional rate hikes.”

While the Fed may skip in September, Scott Anderson, chief economist at Bank of the West, said, “they cannot rule out further rate hikes may be needed either this year or next. The door needs to remain firmly open, in my opinion, especially if inflationary pressures start to move in the wrong direction again.”

While the higher-than-expected July PPI report is “not yet a game changer,” Anderson said, it is “definitely a cautionary signal that price inflation has not yet been completely stomped out.”

The road to 2% inflation will be bumpy, he said, “as energy, food, rents, and other goods and services prices bounce around like a pinball machine.”

Labor disputes and energy prices could cause higher prices, Moya noted, although some suggest the expected slowing of the economy will fuel disinflation.

“This was a notable increase for producer prices and that could very well keep the risk of a November Fed rate hike on the table,” Moya said.

But the price pressures were seen as “modest” by ING Chief International Economist James Knightley. “We believe it right that the market remains doubtful that the Fed will carry through with the final interest rate hike they predicted in their June forecast update.”

Higher borrowing costs, tighter lending standards and the restart of student loan repayments in October will “squeeze” household finances, he said. “We expect the Fed will leave rates on hold through early 2024 with a strong chance of a rate cut as early as next March.”

While the annual rate of PPI is “dramatically” lower that the 11.7% pace of March 2022, “an uptick in PPI components used to calculate PCE inflation skews risks to July headline and core PCE inflation decidedly to the upside,” said Mickey Levy, chief economist for Americas and Asia at Berenberg Capital Markets, a member of the Shadow Open Market Committee.

He sees inflation in the service sector remaining “sticky, reflecting the resilience of the labor market, continued rotation in demand from goods to services, and only modest cooling in wage growth thus far.”

The preliminary August University of Michigan consumer sentiment index, released Friday, dipped to 71.2 from 71.6.

Inflation expectations fell, with the one-year dipping to 3.3% from 3.4%, which Wells Fargo Securities Senior Economist Tim Quinlan and Economic Analyst Jeremiah Kohl called an “interesting development.”

“Consumers are becoming more convinced that inflation is cooling,” they said. “Whether or not they fully understand the Federal Reserve’s role in that is not completely clear, but they are yet to be convinced that we have seen the last of rising interest rates. A majority of consumers still expect interest rate.”

Primary to come

The cities of Dallas and Fort Worth, Texas, (A1/A+/A+/AA) are set to price Tuesday $699.590 million of Dallas Fort Worth International Airport joint revenue refunding and improvement bonds, Series 2023B. Piper Sandler & Co.

Dallas and Fort Worth are also set to price Wednesday $239.725 million of alternative minimum tax Dallas Fort Worth International Airport joint revenue refunding bonds, Series 2023C, serials 2024-2033. Cabrera Capital Markets.

Atlanta (Aa3//AA-/AA+) is set to price Tuesday $696.880 million of airport general revenue bonds, airport passenger facility charge and subordinate lien general revenue bonds, and airport general revenue refunding bonds, consisting of $204.010 of Series 2023B-1, serials 2024-2043, terms 2048, 2053, $25.325 million of Series 2023B-2, serials 2024-2043, terms 2048, 2053, $29.470 million of Series 2023-C, serials 2024-2043, terms 2048, 2053, $38.295 million of Series 2023-D, serial 2044, $254.205 million of Series 2023-E, serials 2024, 2030-2044, $86.980 million of Series 2023-F, serials 2025-2033, $58.595 million of Series 2023-G, serials 2025-2030. BofA Securities.

The Regents of the University of California (Aa2/AA/AA/) is set to price Wednesday $608.160 million of general revenue bonds, Series 2023BQ, serials 2029, 2031, 2033, 2035. Siebert Williams Shank & Co.

The Regents of the University of California is also set to price Wednesday $120.045 million of taxable general revenue bonds, Series 2023BR, serial 2033. Siebert Williams Shank & Co.

The Los Angeles Unified School District (A2//A-/) is set to price Thursday $384.260 million of certificates of participation, sustainability bonds, Series 2023A, serials 2024-2038. BofA Securities.

The city of Colorado Springs, Colorado, (Aa2/AA+//) is set to price Tuesday $360.905 million of utilities system improvement revenue bonds, consisting of $201.750 million of Series 2023A and $159.155 million of refunding Series 2023B. Goldman Sachs.

The Dormitory Authority of the State of New York (Aa2//AA/) is set to price Thursday $300 million of New York and Presbyterian Hospital Obligated Group revenue bonds, Series 2023A. Goldman Sachs.

The state of Louisiana (/AA//) is set to price Tuesday $226.240 of grant anticipation revenue bonds, Series 2023, serials 2024-2035. Wells Fargo.

The city of Chicago (/AA//) is set to price Wednesday $181.295 million of Build America Mutual-insured Chicago O’Hare International Airport customer facility charge senior lien refunding bonds, Series 2023, serials 2028-2043. Barclays.

The Colorado Housing and Finance Authority (Aaa/AAA//) is set to price Wednesday $180 million of federally taxable single family mortgage class-I bonds, Series 2023 N-1, serials 2026-2033, terms 2038, 2041, 2053. RBC Capital Markets.

The Idaho Housing and Finance Association (Aa1///) is set to price Tuesday $149.375 million of fixed-rate single family mortgage bonds, Series 2023C, serials 2024-2034, terms 2038, 2043, 2048, 2053, 2053. Barclays.

The Illinois Finance Authority (A2///) is set to price Tuesday $120 million of theory and computing sciences building trust taxable revenue refunding bonds, Series 2023, serials 2024-2028, term 2033. Fifth Third Securities.

Competitive:

Wisconsin (Aa1/AA+/AA+/AAA) is set to sell $276.155 million of GOs, Series 2023B, at 10:45 a.m. Eastern Tuesday.

Tennessee (Aaa/AAA/AAA/) is set to sell $499.420 million of GOs, Series 2023A, at 10:15 a.m. Wednesday.

Tennessee is also set to sell $44.745 million of federally taxable GOs, Series 2023B, at 10:45 a.m. Wednesday.

Christina Baker contributed to this report.