Municipals were narrowly mixed Tuesday as U.S. Treasury yields rose out long and equities were mildly higher near the close.

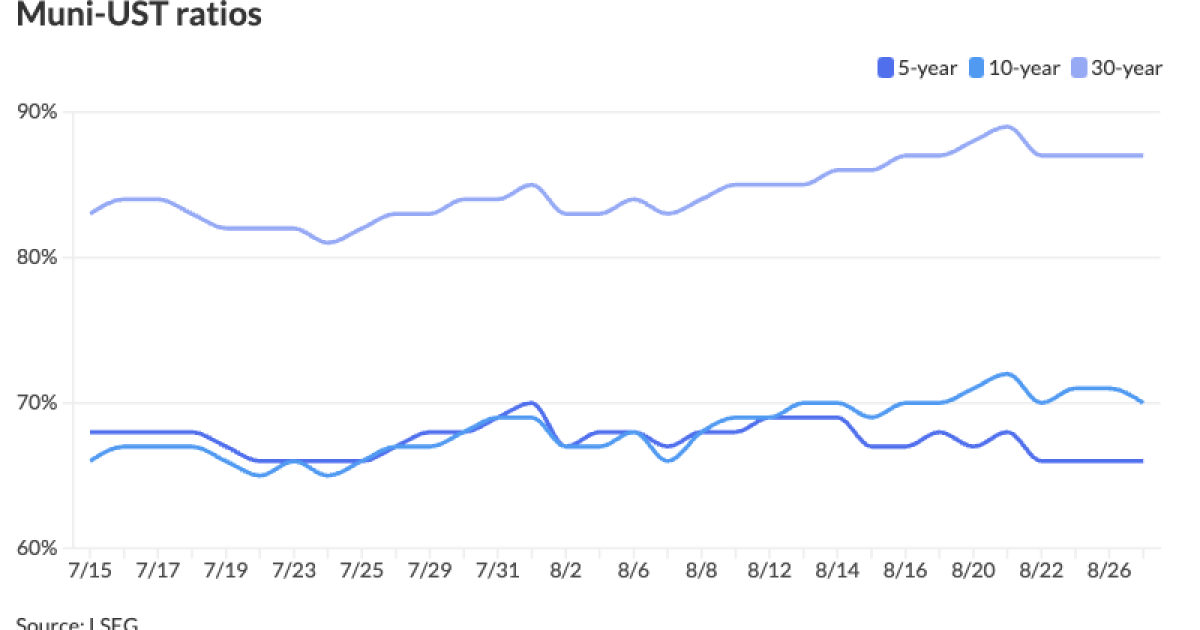

The two-year muni-to-Treasury ratio Tuesday was at 63%, the three-year at 66%, the five-year at 66%, the 10-year at 70% and the 30-year at 87%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the three-year at 64%, the five-year at 66%, the 10-year at 70% and the 30-year at 87% at 3:30 p.m.

As the Fed starts to cut rates, the Treasury market should remain “well bid,” likely boding well for munis as well, said Anders S. Persson, Nuveen’s chief investment officer for global fixed income, and Daniel J. Close, Nuveen’s head of municipals.

“On the whole, the municipal market continues to provide an attractive entry point for investors,” said AllianceBernstein strategists. “And with the Fed clearly communicating that a September rate cut is imminent, the future is bright for the municipal market.”

Issuance will remain “heavy” for the time being, Persson and Close noted.

“Overall, the primary market continues to provide excellent opportunities to put cash to work, and with supply expected to remain elevated in the near term, we expect this trend to continue unless inflows accelerate and drive investors to the secondary market,” AllianceBernstein strategists said.

Of the nearly $9 billion of issuance this week, more than a third comes from two sizable deals, they noted.

In the primary market Tuesday, BofA Securities priced for institutions $2.616 million of various purpose GOs from California (Aa2/AA-/AA/) with yields cut inside 15 years and bumped out long. The first tranche, $817.52 million of new-money bonds, saw 5s of 8/2026 at 2.59% (+10), 5s of 2029 at 2.62% (+10), 5s of 2033 at 2.88% (+7), 5s of 2036 at 3.07% (+12), 5.25s of 2044 at 3.47% (unch), 5s of 2049 at 3.66% (-7), 4s of 2049 at par, 5.5s of 2049 at 3.55% (-7), 4s of 2054 at 4.02% (-12), 5.25s of 2054 at 3.68% (-11) and 5.5s of 2054 at 3.62% (-9), callable 8/1/2034.

The second tranche, $1.799 billion of refunding bonds, saw 5s of 8/2025 at 2.63% (+10), 5s of 2029 at 2.62% (+10), 5s of 2034 at 2.93% (+8), 5s of 2039 at 3.22% (+5), 4s of 2044 at 3.89% and 5s of 2044 at 3.52% (unch), callable 8/1/2034.

Morgan Stanley priced for the Maine Health and Higher Educational Facilities Authority (A1///) $187.65 million of Northeastern University revenue bonds, Series 2024B, with 5s of 10/2036 at 3.19%, 5s of 2039 at 3.32% and 5.25s of 2054 at 4.00%, callable 10/1/2034.

Morgan Stanley priced for Pennsylvania State University (Aa1/AA//) $157.86 million of revenue bonds, Series 2024, with 5s of 9/2025 at 2.56%, 5s of 2029 at 2.49%, 5s of 2034 at 2.84%, 5s of 2039 at 3.14%, 5s of 2044 at 3.54%, 5s of 2049 at 3.76% and 5.25s of 2054 at 3.82%, callable 9/1/2034.

Jefferies priced for Greenville, Texas, (/A//) $125.725 million of electric system revenue and refunding bonds, Series 2024, with 5s of 2/2027 at 2.79%, 5s of 2029 at 2.84%, 5s of 2034 at 3.23%, 5s of 2039 at 3.50%, 5s of 2044 at 3.86%, 5.25s of 2049 at 4.02% and 5s of 2054 at 4.15%, callable 8/15/2032.

BofA Securities priced for the Rhode Island Commerce Corp. (A2/AA-//) $123.59 million of Rhode Island DOT grant anticipation bonds, Series 2024A, with 5s of 5/2032 at 2.92%, 5s of 2034 at 3.03% and 5s of 2039 at 3.32%, callable 5/15/2034.

In the competitive market, Hamilton County, Tennessee, (Aaa/AAA/AAA/) sold $229.31 million of GOs, Series 2024A, to BofA Securities, with 5s of 8/2025 at 2.60%, 5s of 2029 at 2.49%, 5s of 2034 at 2.84%, 5s of 2039 at 3.15%, 5s of 2044 at 3.51%, 5s of 2049 at 3.71% and 5s of 2054 at 3.82%, callable 8/1/2032.

The county also sold $22.71 million of GO refunding bonds, Series 2024B, with 5s of 5/2025 at 2.62%, 5s of 2029 at 2.52% and 5s of 2030 at 2.59%, noncall.

Issuance for August is at $39.803 billion month-to-date — already surpassing August 2023’s $39.369 billion — and several large deals are still expected to price before the end of the month.

Next month will see an expected $43 billion in gross issuance and $11.8 billion in net issuance, said Vikram Rai, head of municipal markets strategy at Wells Fargo.

Coupon payments should be $8.7 billion, bringing the net cash flowing to investors in September to negative $4.2 billion, he said.

“The spike in gross issuance is attributable to a pull forward of the forward calendar,” Rai said, as issuers want to come to market ahead of the election to avoid any volatility.

“On the one hand, there is a chance that this overhang of issuance could weigh on performance since it would exacerbate weak seasonals, but on the other hand, most institutional and sophisticated investors are well aware that issuance will dry up around election time and would want to put investible cash to work when the calendar is heavy,” he said.

“That is, if they have investible cash to put to work, they will use this as a buying opportunity,” Rai added.

Given muni mutual funds have seen

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.51% and 2.45% in two years. The five-year was at 2.42%, the 10-year at 2.69% and the 30-year at 3.57% at 3 p.m.

The ICE AAA yield curve was mixed: 2.57% (-3) in 2025 and 2.47% (-2) in 2026. The five-year was at 2.42% (unch), the 10-year was at 2.66% (+2) and the 30-year was at 3.59% (+1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 2.57% (unch) in 2025 and 2.51% (unch) in 2026. The five-year was at 2.42% (unch), the 10-year was at 2.66% (unch) and the 30-year yield was at 3.55% (+1) at 3 p.m.

Bloomberg BVAL was mixed: 2.51% (unch) in 2025 and 2.46% (-2) in 2026. The five-year at 2.44% (-2), the 10-year at 2.68% (+1) and the 30-year at 3.60% (+2) at 3:30 p.m.

Treasuries were mixed.

The two-year UST was yielding 3.902% (-3), the three-year was at 3.723% (-2), the five-year at 3.658% (-1), the 10-year at 3.832% (+2), the 20-year at 4.213% (+2) and the 30-year at 4.123% (+2) at 3:30 p.m.

Primary to come:

Chicago (//A+/) is set to price Wednesday $1.004 billion of AMT and non-AMT Chicago O’Hare International Airport general airport senior lien revenue bonds, consisting of $563.945 million of AMT bonds, serials 2036-2044, terms 2048, 2053, 2059; and $440.045 million of non-AMT bonds, serials 2036-2044, terms 2048, 2053, 2059. Wells Fargo.

San Antonio, Texas, (Aa2/AA-/AA-/) is set to price Wednesday $763.795 million of electric and gas systems revenue refunding bonds, consisting of $489.525 million of Series 2024D and $274.27 million of Series 2024E. J.P. Morgan.

The Utah Transit Authority is set to price Wednesday $469.915 million in tow series, $327.39 million of sales tax revenue refunding bonds, Series 2024, (Aa2/AA+/AA/), serials 2030-2040; and $94.525 million of subordinated sales tax revenue refunding bonds, Series 2024, (Aa3/AA/AA/), serials 2037-2040. Wells Fargo.

The Texas Veterans Land Board (Aaa///) is set to price Wednesday $135 million of taxable refunding veterans bonds, term 2051. Jefferies.

The Indiana Finance Authority (A3/A-//) is set to price Wednesday $133.96 million of Hendricks Regional Health health facility revenue refunding bonds. Piper Sandler.

The University of Kentucky (Aa3/AA//) is set to price Wednesday $101.255 million of lease purchase obligations, UK Healthcare Cancer Center Parking project, serials 2025-2044, terms 2049, 2054. BofA Securities.

Competitive:

North Hempstead, New York, is set to sell $100.858 million of GO bond anticipation notes at 10:30 a.m. eastern Thursday.