Municipals were firmer Tuesday as several of the week’s $12 billion calendar began pricing, led by New York City’s $1.5 billion being offered to retail investors, as U.S. Treasury yields fell and equities saw losses on the day.

Triple-A yields fell by two to eight basis points depending on the curve, with the best performance up front, but the asset class underperformed the gains made by Treasuries, which saw yields fall by four to seven basis points across the curve.

“Investor reception will remain the ultimate arbiter of muni performance and … the current state of the tax-exempt space to be well-positioned, even though munis are likely to continue to underperform USTs,” said Jeff Lipton, a research analyst and market strategist.

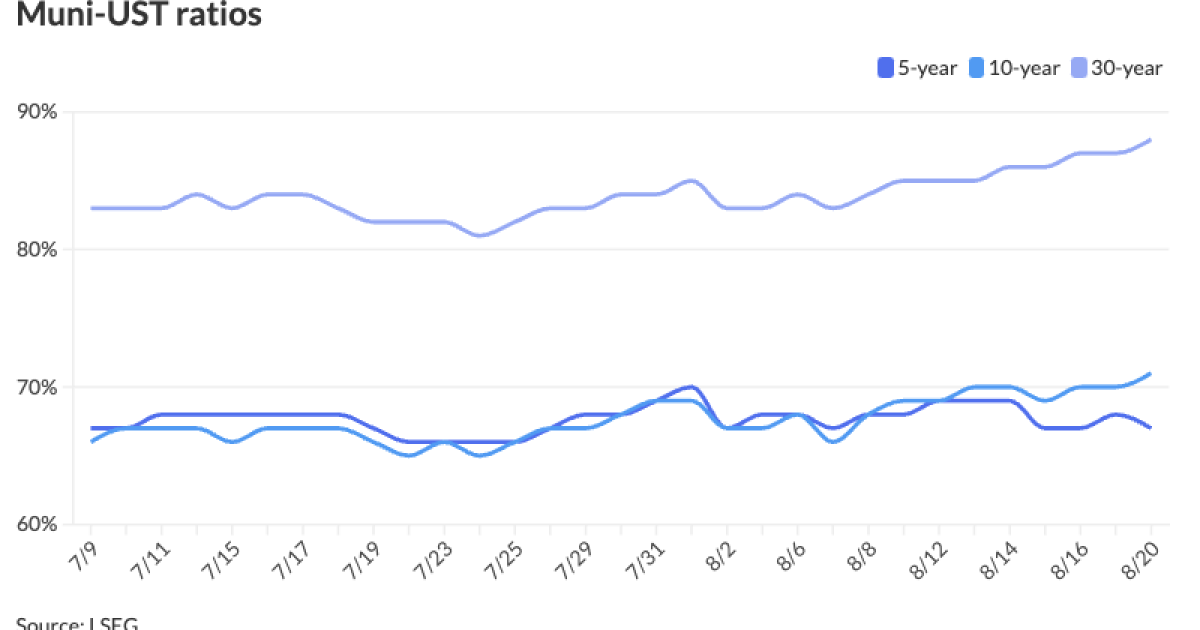

The two-year muni-to-Treasury ratio Tuesday was at 63%, the three-year at 66%, the five-year at 67%, the 10-year at 71% and the 30-year at 88%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the three-year at 65%, the five-year at 66%, the 10-year at 70% and the 30-year at 87% at 3:30 p.m.

“Not all investor cohorts have equal desire for muni product, and particular interest along the curve does have relevance,” Lipton said.

The separately managed account business is expected to “stay committed to shorter tenors, although this will be subject to a slow and methodical process and the nuances of SMA portfolio construction searching for the proper investment buckets, while banks and insurance companies are likely to seek out higher relative value ratios for longer maturities,” Lipton said.

There is a “worsening lack of interest in the municipal long end,” said Matt Fabian a partner at Municipal Market Analytics Inc., noting it reflects “a minimal bid” from insurance companies or banks and better, though still inconsistent flows into longer-strategy muni mutual funds.

“And it’s likely that what flows the funds are receiving are being applied as much as possible to take advantage of performance opportunities (e.g., roll down) and liquidity advantages created by unceasing SMA bidding in the short-intermediate curve areas,” Fabian said.

“And away from favoring defensive coupons again, borrowers do not seem to have much customized their new bond issues for that SMA/interior demand component,” he said.

Thirty-six percent of tax-exempt issuance has a maturity 20 years or longer year-to-date, compared to 35% last year, Fabian said.

“So depleted long-end demand plus outsize par issuance has left the curve’s tail vulnerable to the kind of underperformance seen last week, and in the coming weeks, if long USTs start to rally,” he said.

This provides an opportunity for income investors “willing to carry an untreated wound on your statement into the new year,” Fabian said.

It is more concerning that dealers have “seemingly relied on the SMAs’ slow-but-steady appetite in allowing their inventories to build again, hitting nearly $12 billion prior to last week,” he said.

“For a market now left without meaningful reinvestment flows, this bet requires either the Fed to start some 2a7 cash flowing into bonds, SMAs to ignore lower yields, and/or funds to cultivate new buyer interest despite [year-to-date] underperformance,” he said.

That may happen, but for now, a more “cautious tone” is appropriate, according to Fabian.

In the primary market Tuesday, Loop Capital Markets held a one-day retail order for

Piper Sandler priced for San Antonio, Texas, (Aaa/AAA/AA+/) $357.38 million. The first tranche, $175.975 million of general improvement bonds, saw 5s of 2/2025 at 2.87%, 5s of 2029 at 2.70%, 5s of 2034 at 3.02%, 5s of 2039 at 3.32% and 5s of 2044 at 3.71%, callable 2/1/2034.

The second tranche, $123.85 million of combination tax and revenue certificates of obligation, saw 5s of 2/2025 at 2.87%, 5s of 2029 at 2.70%, 5s of 2034 at 3.02% and 5s of 2035 at 3.10%, callable 2/1/2034.

The third tranche, $55.1 million of tax notes, saw 5s of 2/2025 at 2.87% and 5s of 2027 at 2.72%, noncall.

BofA Securities priced for the Kenton County Airport Board, Kentucky, (A1//A+/) $261.525 million of Cincinnati/Northern Kentucky International Airport revenue bonds. The first tranche, $246.44 million of AMT bonds, Series 2024A, saw 5s of 1/2029 at 3.42%, 5s of 2034 at 3.77%, 5.25s of 2039 at 3.97%, 5.25s of 2044 at 4.23%, 5.25s of 2049 at 4.31% and 5.25s of 2054 at 4.37%, callable 1/1/2034.

The second tranche, $15.085 million of non-AMT bonds, Series 2024B, saw 5s of 1/2026 at 2.84%, 5s of 1/2029 at 2.85%, 5s of 2034 at 3.18%, 4s of 2039 at 3.78%, 4s of 2044 at 4.16%, 4.125s of 2049 at 4.31% and 4.25s of 2054 at 4.37%, callable 1/1/2034.

Siebert Williams Shank priced for the New York State Environmental Facilities Corp. (Aaa/AAA/AAA/) $218.615 million of 2010 Master Financing Program green state revolving funds revenue bonds Series 2024 B, with 5s of 11/2024 at 2.75%, 5s of 5/2029 at 2.51%, 5s of 11/2029 at 2.58%, 5s of 5/2034 at 2.75%, 4s of 11/2034 at 2.83%, 5s of 11/2039 at 3.07% and 5s of 5/2044 at 3.44%, callable 5/15/2034.

Jefferies priced for the Melissa Independent School District, Texas, (/AAA//) $126.515 million of PSF-insured unlimited tax school building bonds, with 5s of 2/2027 at 2.77%, 5s of 2029 at 2.78%, 5s of 2034 at 3.06%, 5s of 2039 at 3.38%, 5s of 2044 at 3.74%, 4s of 2049 at 4.20% and 4s of 2054 at 4.25%, callable 8/1/2034.

In the competitive market, the South Dakota Conservation District (Aaa/AAA//) sold $160.405 million of state revolving fund program bonds to Truist, with 5s of 8/2030 at 2.63%, 5s of 2034 at 2.78%, 5s of 2039 at 3.11%, 5s of 2044 at 3.46%, 5s of 2049 at 3.75% and 5s of 2054 at 3.85%, callable 8/1/2034.

Muni CUSIP requests fall

Municipal CUSIP request volume fell in July on a year-over-year basis, following an increase in June, according to CUSIP Global Services.

For municipal bonds specifically, there was a decrease of 18.1% month-over-month, but a 7.6% increase year-over-year.

For the specific category of municipal bond identifier requests, there was a decrease of 18.1% month-over-month and requests are up 6.3% on a year-over-year basis.

Texas led state-level municipal request volume with a total of 180 new CUSIP requests in July, followed by New York (161) and California (67).

AAA scales

Refinitiv MMD’s scale was bumped up to four basis points: The one-year was at 2.58% (-4) and 2.52% (-4) in two years. The five-year was at 2.48% (-4), the 10-year at 2.71% (unch) and the 30-year at 3.59% (unch) at 3 p.m.

The ICE AAA yield curve was bumped up to four basis points: 2.65% (-3) in 2025 and 2.57% (-4) in 2026. The five-year was at 2.50% (-3), the 10-year was at 2.68% (-1) and the 30-year was at 3.57% (unch) at 4 p.m.

The S&P Global Market Intelligence municipal curve bumped up to five basis points: The one-year was at 2.64% (-4) in 2025 and 2.59% (-4) in 2026. The five-year was at 2.49% (-5), the 10-year was at 2.68% (-2) and the 30-year yield was at 3.56% (unch) at 4 p.m.

Bloomberg BVAL was bumped on bonds 2030 and in: 2.58% (-8) in 2025 and 2.54% (-9) in 2026. The five-year at 2.54% (-3), the 10-year at 2.64% (unch) and the 30-year at 3.56% (unch) at 3 p.m.

Treasuries were firmer.

The two-year UST was yielding 3.995% (-8), the three-year was at 3.799% (-7), the five-year at 3.695% (-7), the 10-year at 3.813% (-6), the 20-year at 4.178% (-6) and the 30-year at 4.066% (-6) at the close.

Primary to come

The Hillsborough County Industrial Development Authority, North Carolina, is set to price Wednesday $1.302 billion of BayCare Health System revenue refunding bonds. Morgan Stanley.

The California Community Choice Financing Authority (A1///) is set to price $1 billion of Athene Annuity-funded Clean Energy Project Revenue Bonds, Series 2024. Goldman Sachs.

Dallas and Fort Worth, Texas, (A1/AA-/A+/AA) are set to price Thursday $713.41 million of Dallas Fort Worth International Airport non-AMT joint revenue refunding and improvement bonds, serials 2028-2044, term 2049. Wells Fargo.

Los Angeles County Public Works Financing Authority (/AA+/AA+/) is set to price Thursday $576.11 million of lease revenue bonds, serials 2024-2044, terms 2049, 2053. BofA Securities.

The South Dakota Housing Development Authority (Aaa/AAA//) is set to price Wednesday $250 million of homeownership mortgage bonds, consisting of $200 million of non-AMT bonds, serials 2029-2030, 2036 and terms 2039, 2044, 2049, 2055; and $50 million of taxables, serials 2025-203. Wells Fargo.

The Nevada Housing Division (/AA+//) is set to price Wednesday $220.525 million of single-family mortgage revenue bonds, consisting of $172.855 million of senior taxable bonds and $47.67 million of senior non-AMT bonds. J.P. Morgan.

The Public Utility District No. 2 of Grant County, Washington, (/AA/AA/) is set to price Wednesday $164.675 million of Priest Rapids Hydroelectric Project revenue refunding bonds. J.P. Morgan.

The Mabank Independent School District, Texas, (/AAA/AAA/) is set to price Thursday $117.97 million of unlimited tax school building and refunding bonds, PSF Insured. FHN Financial Capital Markets.

Competitive

New York City is set to sell $300 million of taxable GOs at 10:45 a.m. Wednesday.

The North Texas Municipal Water District (Aa1/AAA//) is set to sell $153.705 million of Upper East Fork Wastewater Interceptor System Contract revenue refunding and improvement bonds at 11:30 a.m. eastern Wednesday.