Munis were steady to a touch firmer in spots and new-issues fared well in the primary, while U.S. Treasury yields fell and equities ended the trading session up as markets further digested inflation data and its effects on future Fed moves.

Triple-A yields fell a basis point or two, depending on the curve, while USTs saw yields fall three to seven basis points.

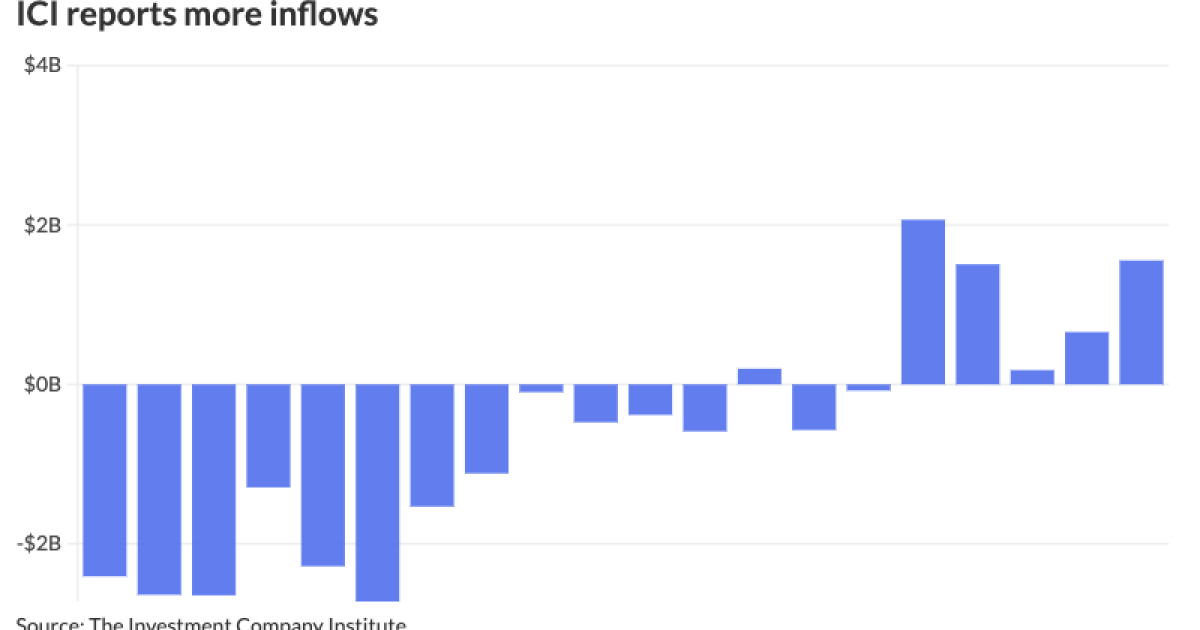

The Investment Company Institute Wednesday reported inflows into municipal bond mutual funds for the week ending Feb. 7, with investors adding $1.555 billion to funds following $657 million the week prior.

This marks the fifth straight week of inflows and differs from LSEG Lipper, which reported

ICI reports exchange-traded funds saw outflows of $463 million following $1.075 billion of inflows the week prior.

Tax-exempt municipal money market funds flipped back to outflows as they saw $900.6 million flow out the week ending Feb. 13, bringing the total assets to $119.84 billion, according to the Money Fund Report, a weekly publication of EPFR.

The average seven-day simple yield for all tax-free and municipal money-market funds fell to 2.97%.

Taxable money-fund assets saw $12.36 billion added to end the reporting week.

The average seven-day simple yield for all taxable reporting funds dipped to 5.01%.

The year has started a bit lackluster from a performance perspective, said AllianceBernstein strategists.

But the backup in yields, “although frustrating, creates a better opportunity as we move toward the second quarter, which is the time the Fed is expected to begin cutting rates,” they said.

With March rate cuts off the table after January’s sell-off inducing jobs report and Tuesday’s consumer price index report that sent UST yields rising up to 20 basis points,

Munis still are outperforming USTs and corporates on a month-to-date and year-to-date basis, said Cooper Howard, a fixed-income strategist at Charles Schwab.

Munis are returning negative 0.31% so far in February and negative 0.82% year-to-date. USTs and corporates are seeing losses of 1.93% and 2.07% month-to-date, respectively, with the former returning negative 2.21% year-to-date and the latter returning negative 2.29% so far in 2024.

“Supply is low this week and

Rates will likely follow the direction of USTs, which, given the “large data dump,” could be more volatile this week, according to Howard.

Outside of 30 years, muni-to-Treasury ratios continue to hover near 60% for most of the curve, he said.

The two-year muni-to-Treasury ratio Wednesday was at 60%, the three-year at 59%, the five-year at 58%, the 10-year at 58% and the 30-year at 81%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 60%, the three-year at 59%, the five-year at 58%, the 10-year at 58% and the 30-year at 80% at 3:30 p.m.

Bank demand has also remained weak, as continuing pressure on institutions from [commercial real estate] exposures and the legacy of 2023 losses, said Matt Fabian, a partner at Municipal Market Analytics. Property and casualty insurance companies are also likely less tempted to buy tax-exempts at current relative value, he said.

This, he said, leaves municipals reliant, as in 2023, on

The overall demand for munis — which should remain “well bid” — is high, “with too much cash chasing too few bonds,” said Anders S. Persson, Nuveen’s chief investment officer for global fixed income, and Daniel J. Close, Nuveen’s head of municipals.

However, “stellar” equity performance year-to-date is a threat, “which will be draining retail enthusiasm from bonds, in particular if the Fed does not begin their rate cutting cycle soon,” Fabian said.

In the primary market Wednesday, BofA Securities priced for the National Finance Authority $500 million of green taxable Hanwha Q Cells USA, Inc. Project industrial development revenue bonds, Series 2024A, with 5.61s of 2/2029 at par.

BofA Securities priced for the California Pollution Control Financing Agency (/BBB+//) $144.205 million of AMT Republic Services Project solid waste disposal refunding revenue bonds, Series 2023, with 4.125s of 7/2043 with a mandatory tender of 8/15/2024 at par.

BofA Securities priced for the Northern Indiana Commuter Transportation District (A1/A+//) $143.430 million of limited obligation consolidated revenue bonds, Series 2024, with 5s of 7/2024 at 3.16%, 5s 1/2029 at 2.74%, 5s of 7/2029 at 2.74%, 5s of 1/2034 at 2.90%, 5s of 7/2034 at 2.90%, 5s of 1/2039 at 3.44%, 5s of 1/2044 at 3.87%, 5.25s of 1/2049 at 4.01% and 5s of 1/2054 at 4.17%, callable 7/1/2034.

RBC Capital Markets priced for the New York State Housing Finance Agency (Aa2///) $133.545 million of sustainability affordable housing revenue bonds, 2024 Series A, with all bonds pricing at par: 3.45s of 11/2063 and 3.375s of 2063.

J.P. Morgan priced for the Public Finance Authority (A2///) $135 million of tax-exempt pooled securities, Series 20241, Class A certificates, with 4s of 9/2059 with a mandatory put date of 2/1/2027 at 4.50%, noncall.

In the competitive market, Virginia (Aaa/AAA/AAA/) sold $61.145 million of GOs, Series 2024A, to BofA Securities, with 5s of 6/2025 at 2.90%, 5s of 2029 at 2.46%, 5s of 2034 at 2.51%, 5s of 2039 at 2.99% and 4s of 2044 at 3.75%, callable 6/1/2034.

The state also sold $118.675 million of GO refunding bonds, Series 2024B, to BofA Securities, with 5s of 6/2025 at 2.90%, 5s of 2029 at 2.46% and 5s of 2034 at 2.51%, noncall.

Secondary trading

California 5s of 2025 at 2.93%. NYC TFA 5s of 2025 at 2.90% versus 2.88% Friday. Virginia College Building Authority 5s of 2026 at 2.78% versus 2.74% Monday.

Minnesota 5s of 2028 at 2.50%. NY Dorm PIT 5s of 2029 at 2.55%-2.45% versus 2.58% Tuesday. NY State Urban Development Corp. 5s of 2030 at 2.52%-2.50%.

University of California 5s of 2033 at 2.35%-2.36%. Raleigh Combined Enterprise System 5s of 2035 at 2.61%. NYC TFA 5s of 2036 at 2.85%-2.84% versus 2.83%-2.82% Tuesday and 2.78% Friday.

LA DWP 5s of 2048 at 3.45%. Triborough Bridge and Tunnel 5s of 2049 at 3.86%-3.82% versus 3.79%-3.78% Tuesday and 3.79%-3.78% Monday.

AAA scales

Refinitiv MMD’s scale was bumped two basis points on the short end: The one-year was at 2.96% (-2) and 2.76% (-2) in two years. The five-year was at 2.46% (unch), the 10-year at 2.48% (unch) and the 30-year at 3.62% (unch) at 3 p.m.

The ICE AAA yield curve was bumped one to two basis points: 2.98% (-2) in 2025 and 2.79% (-2) in 2026. The five-year was at 2.50% (-1), the 10-year was at 2.49% (-1) and the 30-year was at 3.57% (-1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.01 in 2025 and 2.81% in 2026. The five-year was at 2.49%, the 10-year was at 2.50% and the 30-year yield was at 3.60%, according to a 3 p.m. read.

Bloomberg BVAL was little changed: 2.96% (unch) in 2025 and 2.81% (-1) in 2026. The five-year at 2.47% (unch), the 10-year at 2.54% (unch) and the 30-year at 3.65% (unch) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.577% (-7), the three-year was at 4.385% (-7), the five-year at 4.244% (-7), the 10-year at 4.260% (-5), the 20-year at 4.553% (-4) and the 30-year Treasury was yielding 4.435% (-3) at 3:45 p.m.

Negotiated calendar

The Gloucester County Improvement Authority, New Jersey, (/AA//) is set to price Thursday $167.240 million of BAM-insured Rowan University projects loan revenue bonds, Series 2024, serials 2034-2044, terms 2049, 2054. Stifel, Nicolaus & Co.

The Missouri Housing Development Commission (/AA+//) is set to price Thursday $130 million of single-family mortgage revenue bonds, consisting of $120 million of non-AMT first place homeownership loan program bonds, 2024 Series A, serials 2025-2036, terms 2039, 2044, 2049, 2054, 2055; and $10 million of taxable first place and next step homeownership loan program bonds, 2024 Series B, serials 2025-2034, terms 2039, 2044, 2049, 2054. Raymond James.

Competitive

Glendale, California, is set to sell $153.850 million of electric revenue bonds, at 11 a.m. Thursday, and $53.765 million of electric revenue refunding bonds, at 11:30 a.m. Thursday.

Hudson County, New Jersey, is set to sell $140.605 million of bond anticipation notes, Series 2024, at 11 a.m. Thursday.

The Cherokee County School System, Georgia, (Aa1/AA+//) is set to sell $100 million of GOs at 10:30 a.m. Thursday.