Municipals were firmer Wednesday but underperformed a U.S. Treasury rally after the Fed held rates steady. Equities rallied as well.

The municipal market was up “a touch” after the Fed announced it would keep rates unchanged at their November meeting, according to Michael Pietronico, chief executive officer at Miller Tabak Asset Management.

Commenting on the Fed’s statement that a December hike is less likely due to tighter financial and credit conditions weighing on the economy, Pietronico said on X, formerly known as Twitter, Wednesday afternoon that the Fed is ”basically admitting [the] bond market did the dirty work with the spike in yields.”

The acknowledgement the tightening of financial conditions, and not just credit, may lead some to take this “as a sign that the bond market will continue to help them with this tightening cycle, which could support the argument that a peak in rates is in place,” said Edward Moya, senior market analyst at The Americas OANDA.

Triple-A yields fell two to four basis points on the day while USTs rallied up to 15 basis points. As a result of falling yields, muni-UST ratios rose. The two-year muni-to-Treasury ratio Wednesday was at 73%, the three-year was at 74%, the five-year at 74%, the 10-year at 74% and the 30-year at 92%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 73%, the three-year at 74%, the five-year at 72%, the 10-year at 73% and the 30-year at 89% at 3:30 p.m.

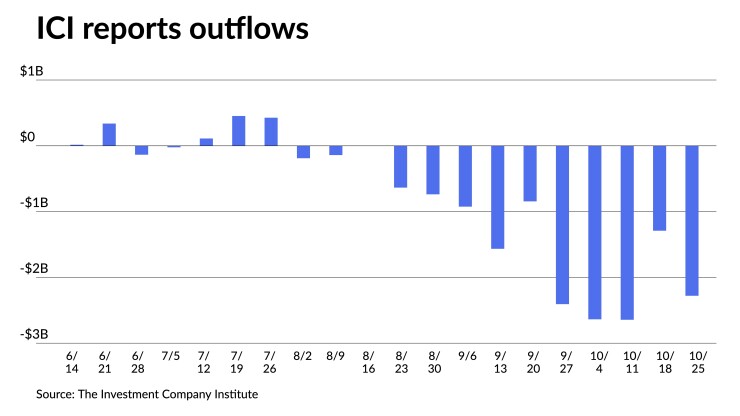

Municipal mutual fund losses intensified last week as the Investment Company Institute Wednesday reported investors pulled $2.280 billion from the funds in the week ending Oct. 25 after $1.291 million of outflows the previous week.

Exchange-traded funds, though, saw another week of inflows to the tune of $666 million after inflows of $552 million the week prior, according to ICI.

October in the red

“October’s price performance resulted in a triple — that is, the third consecutive monthly loss of the year and ironically mirroring how August, September and October 2022 performed,” noted Kim Olsan, senior vice president of municipal trading at FHN Financial. “Price weakness created a short(er) and safe(er) bias during the month, as supply overwhelmed available reinvestment flows and mutual fund redemptions of $9 billion across four weeks left bidders in control.”

Municipal losses continued in October. The Bloomberg Muni Index posted a negative 0.85% return in October and losses of 82.22% year to date. High-yield lost 1.60% for the month and 1.60% for 2022 while taxables lost 2.05% in October and 1.19% in 2022 so far.

Olsan noted the rate volatility throughout October gave more strength to secure sectors. The general obligation index lost 0.6% but a broad revenue index gave up just shy of 1%.

Olsan pointed out that as revenue bond issuance increased 70% from a year prior — four of the five largest deals in October were revenue credits — GO issuance fell 11%. “Year-to-date results have still favored revenue bond allocations with a 50 basis point excess gain to the GO index, indicative of a 13% decline in supply while GO issuance is essentially flat to 2022,” she said.

The safer approach was evident in how sub-sectors within the revenue category performed, she said.

A water/sewer bond index lost 0.8%, “matching the broad market result,” she said. Contrasting that, healthcare was down 1.6% and transportation bonds lost 1%.

“What appears to have occurred during the month is a risk-off shift in allocations relative to supply conditions — water/sewer volume is down 6% while healthcare supply is off 50% and transportation issuance has fallen 24%,” Olsan said.

Taxable munis ended October with losses of 2% which moved 2023 returns into the negative by 1.1%.

“Comparative returns in taxable sectors placed munis at the higher end of losses — a UST index lost 1.2%, the U.S. Aggregate index closed the month down 1.5% and a US MBS index loss matched that of the taxable muni index,” Olsan noted.

The short-end (one to two-year) once again closed in the black and Olsan pointed out it is the only muni category positive for the year.

Intermediate durations fared better than long-term bonds, posting a loss of 0.6% to the 2% loss of the long index, she said.

“At end of 10 months, a 200 basis point selloff in the 30-year spot has moved the year-to-date loss to nearly 4%,” Olsan said.

In the primary market Wednesday, RBC Capital Markets priced for the Connecticut Housing Finance Authority (Aaa/AAA//) $190.125 million of social housing mortgage finance program bonds, 2023 Series D, with all bonds pricing at par — 3.8s of 11/2024, 4.1s of 5/2028, 4.15s of 11/2028, 4.55s of 5/2033, 4.6s of 11/2033, 4.9s of 11/2038, 5.125s of 11/2043 and 5.35s of 11/2048 — except 6.25s of 5/2054 at 5.00%, callable 11/15/2032.

Secondary trading

California 5s of 2024 at 3.76%-3.74% versus 4.00% Tuesday. Maryland 5s of 2024 at 3.73%-3.58% versus 3.74% on 10/25. Minnesota 5s of 2025 at 3.69%.

Georgia 5s of 2028 at 3.51%-3.50% versus 3.52%-3.53% on 10/25 and 3.54% on 10/20. California 5s of 2029 at 3.62% versus 3.61% on 10/26. Maryland 5s of 2029 at 3.60% versus 3.60% on 10/23.

California 5s of 2033 at 3.71%-3.70% versus 3.71% on 10/25. DC 5s of 2033 at 3.69% versus 3.73% Monday and 3.78% Friday. Delaware 5s of 2034 at 3.60%-3.58%.

NYC TFA 5s of 2048 at 4.95%-4.92% versus 4.96% on 10/26 and 4.94% on 10/25. Massachusetts 5s of 2053 at 4.84%-4.86% versus 4.86%-4.69% Monday and 4.84% on 10/26.

AAA scales

Refinitiv MMD’s scale saw bumps throughout most of the curve: The one-year was at 3.74% (-2, no roll) and 3.65% (-2, no roll) in two years. The five-year was at 3.49% (-2, no roll), the 10-year at 3.58% (-4, +1bp Nov. roll) and the 30-year at 4.57% (unch) at 3 p.m.

The ICE AAA yield curve was bumped two to three basis points: 3.72% (-2) in 2024 and 3.70% (-2) in 2025. The five-year was at 3.51% (-2), the 10-year was at 3.56% (-2) and the 30-year was at 4.54% (-3) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped up to three basis points: The one-year was at 3.77% (-2) in 2024 and 3.69% (-2) in 2025. The five-year was at 3.54% (-2), the 10-year was at 3.59% (-3) and the 30-year yield was at 4.58% (unch), according to a 3 p.m. read.

Bloomberg BVAL was cut bumped one to two basis points: 3.78% (-1) in 2024 and 3.72% (-1) in 2025. The five-year at 3.51% (-1), the 10-year at 3.61% (-1) and the 30-year at 4.57% (-2) at 3:30 p.m.

Treasuries rallied.

The two-year UST was yielding 4.949% (-12), the three-year was at 4.769% (-12), the five-year at 4.670% (-15), the 10-year at 4.759% (-13), the 20-year at 5.128% (-10) and the 30-year Treasury was yielding 4.944% (-10) near the close.

FOMC

With a wary eye on inflation, and acknowledging a stronger economy and, the Federal Open Market Committee held its interest rate target at a range of 5.25% to 5.50%.

“Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation,” the panel’s post-meeting statement said. “The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.”

In his press conference, Chair Jerome Powell reiterated the panel would “proceed carefully” and decisions would be made on “a meeting-by-meeting basis.”

The Fed does not see a recession in the near term, Powell said, and they are not yet discussing rate cuts.

The statement “marks the official end of the hiking cycle,” said Thomas Holzheu, Swiss Re chief economist for the Americas. “The sharp rise in long-term bond yields has reduced the need for further rate hikes as tighter financial conditions can substitute for a higher terminal policy rate.”

The war in Israel will lead to volatile oil prices into next year, he said, and while this will not cause the Fed to raise rates, it could “delay the start of the easing cycle further out into 2024 and potentially 2025 if inflation pressures reaccelerate.”

The statement was neither hawkish or dovish, according to Morgan Stanley economists, since rates were held and the Fed added “financial conditions” to the list factors that could “weigh on the economy.”

“The statement acknowledges the recent pick-up in growth and the resilience in hiring,” noted Fitch Ratings Chief Economist Brian Coulton. “There was a notable absence of any reference to the backup in bond yields since the last FOMC meeting. Chair Powell has repeatedly warned of the risks to achieving the FOMC’S inflation goals if growth picks up and the labor market stays tight. And with core CPI services inflation still at 5.7% and wage growth only falling gradually, we still expect one more hike in this tightening cycle.”

Despite the vibrant third quarter GDP number and a strong labor market, Mortgage Bankers Association SVP and Chief Economist Mike Fratantoni said as “long as inflation continues to come down, the Fed is likely to pause at this level for some time. We expect its next move will be a cut in next year’s second quarter.”

Disinflation will continue and the Fed will likely keep rates steady into next year, said Whitney Watson, global co-head and co-chief investment officer of fixed income and liquidity solutions at Goldman Sachs Asset Management.

But “there are risks in both directions,” Watson warned. “The rise in inflation expectations, owing to higher gas prices, combined with strong economic activity, preserves the prospect of another rate hike. Conversely, a more pronounced economic slowdown caused by the growing impact of higher interest rates might accelerate the timeline for transitioning to rate cuts.”

The Fed is likely done with its hiking cycle, said Bryce Doty, senior vice president and senior portfolio manager at Sit Investment Associates. “This paves the way for the yield curve to continue to normalize and move toward an upward slope, especially from 2-year Treasury maturities on out. This will most likely happen with both 2-year maturity yields declining and 30-year maturity yields rising.”

The Fed is trying to “reduce consumer and aggregate demand but not so much as to cause a recession that leads to painfully high unemployment,” noted Lon Erickson, portfolio manager at Thornburg Investment Management. “They need all the luck in the world.”

But there were few clues as to future moves, said BMO Deputy Chief Economist Michael Gregory. ”In the presser, Powell even avoided saying the Fed had a formal ‘tightening bias.'”

While the FOMC maintains a meeting-by-meeting approach, to “assess whether it has achieved sufficiently restrictive monetary policy,” he said, “the Fed judges it’s not there yet, but financial conditions are working to steer them in that direction. We’ll see where this lands by mid-December, after a couple iterations of key data.”

Primary to come

The Avon Community School Building Corp. (/AA+//) is set to price Thursday $150 million of ad valorem property tax first mortgage bonds, Series 2023, serials 2027-2043. Stifel, Nicolaus & Co.

Christine Albano and Gary Siegel contributed to this report.