After selling off for a week and a half, munis ended Friday’s session firmer, but September losses moved the asset class into the red for the year, returning -1.79%.

“September and to a lesser degree October have not been kind to municipal investors in recent history, with average returns of -5.7% and -1.8%, respectively, going back five years,” noted Barclays PLC strategists in a weekly report. “This month, both the IG and HY indices lost 3.3% and 3.9% respectively, which is consistent with this trend.”

With this month’s losses, the Bloomberg Municipal Index has returned -1.79% for the year while High-Yield year-to-date losses are at -0.50%. Taxable muni losses hit -2.93% for the month, bringing year-to-date returns to positive 0.83%, while the short index saw gains of 0.02% in September, bringing 2023 returns to 1.99% in the black, per Bloomberg data.

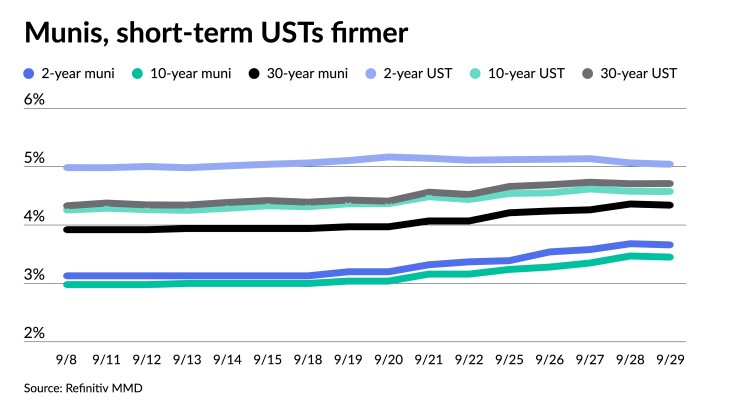

The sharp sell-off in Treasuries that started about a month ago continued this week, with yields 15-20 basis points higher, and a curve that bear-steepened, noted Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel.

“Typically, tax-exempts outperform during market sell-offs, but when technicals are not overly supportive (like they are right now), municipals actually underperformed — more so on the front end that was relatively rich to begin with, reaching more appropriate levels,” they said.

As the selloff happened toward the close of 3Q, BofA strategists believe “some technicals factors are at work here, with the purpose of setting up entries for 4Q performance.”

The municipal yield curve also bear steepened in the front-end with the “3s5s bucket of the index curve is now nearly dis-inverted, while the 5s10s is about 10-12bp steep; as the 10-year part of the yield curve is underperforming, similar to what happened last October, the long end is actually outperforming slightly,” Barclays strategists said.

“The muni market already feels somewhat vulnerable, and heavier outflows will likely re-start yet again after such a dramatic rates move,” the report said.

Supply in September rose to $27.585 billion and for the first month this year, it was larger than September 2022’s figure.

Supply is expected to remain heavy in October, Barclays said, “likely putting even more pressure on the market.”

But “the internal market demand/supply picture for munis in October will significantly improve versus September’s,” BofA strategists said.

Total principal redemption and coupon payments for October are projected to exceed $40 billion, $4 billion higher than in September. This will be followed by $41 billion for November and $56 billion for December, they noted.

Starting several years ago, “there was a steady trend for shortening duration in the primary market — the share of bonds in the 0-10y maturity bucket has been steadily growing, while those in the 10-20y, and in the 20-30y (especially light this year) has been steadily falling,” Barclays strategists said.

“This is yet another reason why the front and belly of the muni yield curve might be affected to a larger degree than longer-dated bonds,” they said.

Barclays strategists pointed to the market turnaround in October of last year. While they are not sure when municipal yields will reach their peak, “we strongly feel that in the next several weeks investors could be presented with an attractive opportunity.”

“It is rare to see high-quality bonds with a 5% coupon trading at a discount, and it has started to happen already,” they said. “Historically this was a buying trigger for retail investors, and we might see them back in action yet again in short order. Some of the lower-coupon bonds also present a pretty good opportunity, although de minimis might play a role when considering whether to buy bonds.”

Even though yields are “already attractive, we are looking for a better relative value opportunity for tax-exempts,” they said.

If 10-year municipal to UST ratios reach the high 70s, and 30-year to mid-90s, “we would view it as a signal to start adding, although we would not be averse to start slowly adding even at current levels,” they added.

The two-year muni-to-Treasury ratio Friday was at 72%, the three-year was at 73%, the five-year at 74%, the 10-year at 75% and the 30-year at 92%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 72%, the three-year at 73%, the five-year at 72%, the 10-year at 74% and the 30-year at 92% at 4 p.m.

New-issue calendar

The calendar climbs to an estimated $8.556 billion next week with $6.644 billion of negotiated deals on tap and $1.912 billion on the competitive calendar.

The San Diego County Regional Airport Authority leads the negotiated calendar with $1 billion of senior airport revenue bonds, followed by $965 million of taxable social bonds from New York City and $823 million of restructuring bonds from the Utility Debt Securitization Authority.

The competitive calendar is led by California with $942 million of taxable various purpose GOs.

Secondary trading

Maryland 5s of 2024 at 3.80%-3.65% versus 3.82% Thursday and 3.56%-3.52% on 9/22. Massachusetts 5s of 2025 at 3.70% versus 3.73% Thursday. Connecticut 5s of 2026 at 3.69%.

NYC 5s of 2028 at 3.60%-3.55%. California 5s of 2028 at 3.40% versus 3.36% Wednesday and 2.99% on 9/18. Triborough Bridge and Tunnel Authority 5s of 2029 at 3.55% versus 3.05% on 9/15.

Maryland 5s of 2032 at 3.58%. DASNY 5s of 2033 at 3.77%-3.72%. California 5s of 2034 at 3.57% versus 3.62%-3.61% Thursday and 3.30% on 9/21.

Washington 5s of 2048 at 4.52%-4.46% versus 4.61%-4.60% Thursday and 4.51% Tuesday. Massachusetts Transportation Fund 5s of 2051 at 4.53% versus 4.31% on 9/20.

AAA scales

Refinitiv MMD’s scale was bumped two basis points: The one-year was at 3.70% (-2) and 3.66% (-2) in two years. The five-year was at 3.41% (-2), the 10-year at 3.45% (-2) and the 30-year at 4.34% (-2) at 3 p.m.

The ICE AAA yield curve was bumped up to three basis points: 3.73% (unch) in 2024 and 3.65% (unch) in 2025. The five-year was at 3.36% (-1), the 10-year was at 3.38% (-1) and the 30-year was at 4.32% (-3) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped two basis points: The one-year was at 3.71% (-2) in 2024 and 3.66% (-2) in 2025. The five-year was at 3.43% (-2), the 10-year was at 3.45% (-2) and the 30-year yield was at 4.34% (-2), according to a 3 p.m. read.

Bloomberg BVAL was bumped three to five basis points: 3.71% (-3) in 2024 and 3.63% (-3) in 2025. The five-year at 3.36% (-3), the 10-year at 3.42% (-5) and the 30-year at 4.36% (-5) at 4 p.m.

Treasuries were firmer five years and in.

The two-year UST was yielding 5.040% (-2), the three-year was at 4.798% (-3), the five-year at 4.605% (-2), the 10-year at 4.574% (flat), the 20-year at 4.913% (+1) and the 30-year Treasury was yielding 4.710% (flat).

Primary to come

The San Diego County Regional Airport Authority (A1//AA-/) is set to pricce $1.03 billion of senior airport revenue bonds Tuesday. Serials, 2024-2025, 2028-2043, terms 2048, 2053, 2058. Jefferies.

New York City (Aa2/AA/AA/AA+) is set to price $965 million of taxable general obligation bonds Wednesday. Serials, 2025-2038, terms 2046, 2053. Barclays Capital.

The Utility Debt Securitization Authority of New York State (Aaa/AAA//) is set to price $823.3 million of tax-exempt and taxable restructuring bonds Tuesday. J.P. Morgan Securities.

The Omaha Public Power District (Aa2/AA//) is set to price $581.8 million of electric system revenue bonds Tuesday. Serials 2025-2043, terms 2048, 2053. Goldman Sachs & Co. LLC.

Fort Lauderdale, Fla. (Aa1/AA+//) is on tap to price $504.9 million of water and sewer revenue bonds for the Prospect Lake Water Treatment Plant Project Thursday. Morgan Stanley & Co. LLC.

The Tennessee Housing Development Agency (Aa1/AA+//) is set to issue $305 million of residential finance program bonds Tuesday. Serials 2024-2035, terms 2038, 2043, 2048, 2053, 2054. Citigroup Global Markets Inc.

South Carolina’s Building Equity Sooner for Tomorrow (Aa2///) is set to price $275.8 million of installment purchase revenue refunding bonds on behalf of the School District of Greenville County, S.C., Wednesday. J.P. Morgan Securities LLC.

The Alameda County, Calif., (Aa1/AA+/AA+/) is set tor price $197.3 million of lease revenue refunding bonds for the Highland Hospital Project Thursday. Serials 2024-2034. Citigroup Global Markets Inc.

The Illinois Housing Development Authority (Aaa///) is set to price $178.7 million of revenue bonds Thursday. Serials 2025-2035, terms 2038, 2043, 2047 2053. Wells Fargo Bank.

The Chicago Park District ( /AA-/AA-/AA) is set to price $167.4 million of GO limited tax park bonds and refunding bonds, and unlimited tax and refunding bonds Tuesday. Mesirow Financial Inc.

The Virginia Housing Development Authority (Aaa/AAA//) is set to issue $150 million of taxable commonwealth mortgage bonds Wednesday. Serials 2024-2033, terms 2038, 2043, 2048, 2053. BofA Securities. It will also issue $100 million of non-AMT commonwealth mortgage bonds Wednesday. Serials 2024-2035, terms in 2038, 2043, 2048, 2053.

The New York State Housing Finance Agency (Aa2///) is set to price $149.5 million of affordable housing sustainability revenue bonds Wednesday. Serials 2024-2035, terms 2038, 2043, 2048, 2053, 2058, 2062 2063. Ramirez & Co., Inc.

The Florida Housing Finance Corp. (Aaa///) is set to price $100 million of Series 6 taxable homeowner mortgage revenue bonds Thursday. Serials 2025-2033, terms 2038, 2043, 2048, 2054, 2055. Citigroup Global Markets Inc.

Competitive

Montgomery County, Pa., (Aaa///) will sell $151.1 million of GO debt Tuesday. Serials 2024-2043.

California (Aa2/AA-/AA/) is set to sell a total of $943 million of taxable GOs Wednesday — $440 million maturing serially in 2031 and 2041 and $502 million maturing serially in 2028 and 2031.

Christine Albano contributed to this story.