Lithium-ion batteries have already changed the world, putting smartphones, laptops and wireless headphones in the hands of billions of people. Now they are triggering another revolution.

The technology of choice both in electric cars and the nascent electricity storage industry, the cells will be a vital pillar in the global transition to a carbon-free economy.

As demand soars, the rollout promises huge rewards. Global lithium ion battery revenues will grow to $700bn a year by 2035, according to consultancy Benchmark Mineral Intelligence, by which time $730bn will have to be poured into battery plants, mines and processing facilities to meet the need not just for lithium but for other ingredients including nickel and cobalt.

“This is going to be a race to see who can develop the most advanced technologies in the world,” said Glen Merfeld, chief technology officer of Albemarle, the world’s largest lithium company.

With two principle branches of lithium-ion technology vying for supremacy, winners and losers will be decided in the coming years as companies race to supply the world, from carmakers including Tesla, Volkswagen and BYD, and battery makers CATL and LG Energy Solution, to mining companies such as Glencore and BHP.

Rise of lithium-ion

Invented in the 1970s by US-based scientists and commercialised in 1991 by Japan’s Sony to power its Handycam video cameras, lithium-ion cells pack far more punch in smaller and lighter units than the lead acid or nickel cadmium units that previously dominated the rechargeable battery market.

Having helped give birth to the portable electronics industry, lithium-ion batteries have fought off competing technologies to become the dominant force in electric cars after a 90 per cent drop in cost over the past decade. Total global deployment of the technology could top 1 terawatt-hours this year, equivalent to 17mn average-sized electric cars, according to London-based battery consultancy Rho Motion.

While demand is also set to surge for grid storage, an industry that will need to expand hugely to address the intermittent nature of solar and wind power as fossil fuel plants are phased out, the vast majority of investment is flowing into the far larger market for electric vehicles.

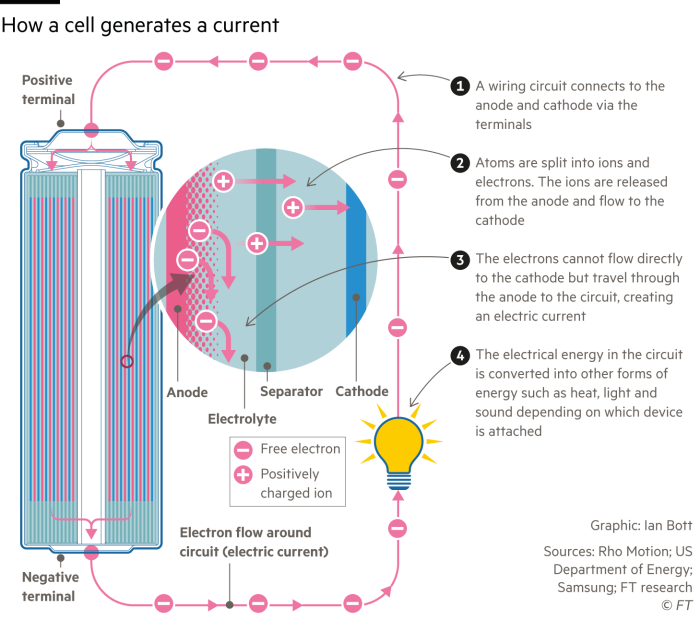

All batteries work on the same principle, producing a current as a stream of ions — electrically charged atoms — flows through a chemical material known as an electrolyte from the anode to the cathode, the cell’s two electrodes. The flow is reversed during recharging.

Lithium-ion refers to a whole category of batteries, describing the type of ion transferred between anode and cathode rather than the electrode materials themselves, which vary widely.

Advanced material innovations have led to a range of lithium-ion batteries, catering not only to different applications but also the characteristics desired by a car manufacturer or utility. These include cost, weight, driving range, charging time, the number of charging cycles before failure, and safety — a growing concern given a spate of fires set off by lithium-ion devices.

“The lithium-ion gave us a platform to discover new materials that could go into the anode, cathode and electrolyte,” said Venkat Srinivasan, director of the Argonne Collaborative Center for Energy Storage Science, part of a US national laboratory.

Anodes are typically made of graphite and dictate how quickly a battery can charge while cathodes, which come in a variety of materials, are the main determinant of a battery’s cost and the amount of energy it can store.

In the electric car market two main cathode chemistries are fighting it out: NMC, which uses lithium, nickel, manganese and cobalt in varying quantities, and LFP made of lithium, iron and phosphate.

Race between two technologies

South Korean manufacturers LG Energy Solution and Samsung SDI excel at producing NMC cathodes, which are used in the majority of electric vehicles sold in the west where their longer range is better suited to driving habits. But Chinese companies still account for 75 per cent of global production, according to Benchmark data.

China is almost totally dominant in LFP batteries, accounting for 99 per cent of world output. The technology has taken the country by storm thanks to improvements in energy density, its higher safety levels and its lower cost compared with cells containing cobalt and nickel, as well as manufacturing breakthroughs. LFP’s share of the Chinese market has surged to 60 per cent from 18 per cent in just three years, Rho Motion estimates.

“The Chinese have cracked the code on LFP,” said Chris Berry, president of House Mountain Partners, a Washington-based battery metals advisory firm.

The battle between the cathode chemistries will exert huge influence over global supply and demand of lithium, nickel, cobalt and manganese, aiding or thwarting supplier nations such as Indonesia, the Democratic Republic of Congo and Chile.

Meanwhile, the choices of consumers, politicians and carmakers will play a crucial role in either cementing China’s grip over the global electric vehicle market or loosening it and risking a slower, more costly energy transition.

“One-third of the value of a passenger car is the battery,” said Dirk Uwe Sauer, professor in battery and energy system research at RWTH Aachen University in Germany. “By not having control of this technology, we will have lots of difficulties in the near future in a world where you can’t be sure who will be your friend and deliver things tomorrow.”

Western start-ups are working on developing their own LFP technology while Korean battery makers are playing catch-up with the Chinese. LG Energy Solution, the largest producer of EV batteries after China’s CATL, announced in March that it would allocate $2.3bn of a $5.5bn manufacturing investment in Arizona to LFP battery production for energy storage systems.

“You’re talking about building infrastructure for an industry that needs to grow 10 times in the next few years,” said Michael Finelli, president of growth initiatives at Solvay, a battery component supplier. “While a battery is just a storage device, it’s a critical component of the energy transition . . . These things are considered items of national security now. You don’t want to be reliant on another country.”

Global carmakers are asking Korean companies to make LFP batteries but “Korea can’t win a price war with China in this segment, given China’s huge state backing”, according to Sun Yang-Kook, a battery expert at Hanyang University in Seoul.

In taking the LFP lead, Chinese manufacturers have developed means of producing the technology cheaply and at scale, putting the west in a bind.

Ford, for example, has found itself at the centre of a political storm in Washington after partnering with CATL on a licensing deal to produce LFP batteries in the US.

West’s dilemma over China’s dominance

In the coming years, lithium-ion batteries are likely to undergo tweaks that improve performance and reduce cost, for example by adding manganese to the cathode, blending more silicon in the graphite anode or increasing nickel at the expense of cobalt in NMC cells.

Some expect more radical change, arguing that next-generation technologies such as sodium-ion and solid-state batteries could make inroads this decade.

But Tim Wood-Dow, lead analyst for nickel and cobalt at Trafigura, one of the world’s largest commodity traders, said the biggest swing factor on the battery market in the coming decade would be which way the west went on the two main cathode types.

“Battery investment has all been NMC in the west,” he said, but “there could be a significant switch to LFP” later this decade.

The choice for the US and Europe, battery insiders say, ultimately represents the delicate balance the west must strike between reducing reliance on China or accepting it as the cost of maintaining access to highly competitive and affordable technologies.

“The problem is how to compete with China,” said Shirley Meng, a materials scientist at the University of Chicago, adding that while the US government was pushing to reduce the country’s reliance on the Asian nation, “the Chinese have the knowhow . . . there’s no point reinventing the wheel when the Chinese have optimised the process”.

This article is the first of a four-part series on next-generation batteries