Municipals were slightly firmer Thursday, outperforming U.S. Treasuries, as the last large new-issues of the week priced and mutual fund inflows returned. U.S. Treasuries saw losses across the curve following the July inflation read while equities closed out the session in the black.

While the consumer price index came in mostly as expected, analysts remain divided on the future of monetary policy, although most see a pause when the Federal Open Market Committee meets Sept. 19-20.

Triple-A yields saw a basis point or two bump while Treasuries rose five to 10 basis points.

Ratios fell slightly as a result. The two-year muni-to-Treasury ratio Thursday was at 64%, the three-year at 65%, the five-year at 66%, the 10-year at 66% and the 30-year at 87%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 65%, the three-year at 66%, the five-year at 66%, the 10-year at 67% and the 30-year at 88% at 4 p.m.

Municipal bond mutual funds

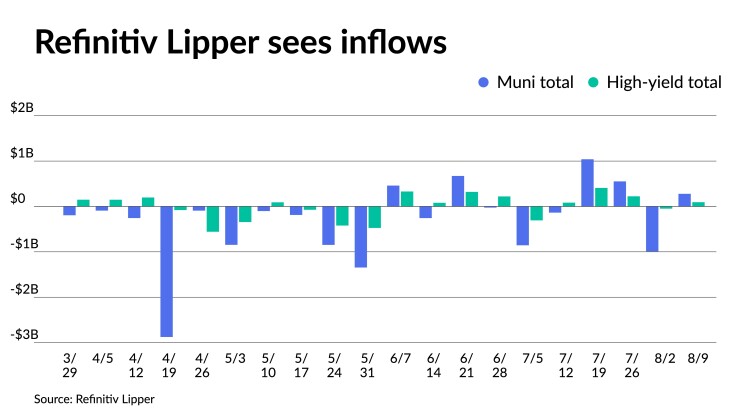

Refinitiv Lipper reported $278.559 million of inflows into municipal bond mutual funds for the week ending Wednesday, led by exchange-traded funds. This followed $989.852 million of outflows from the funds the previous week. Exchange-traded funds saw inflows of $281.644 million after outflows of $675.259 million in the prior week.

In the primary market, RBC Capital Markets priced for the Pecos-Barstow-Toyah Independent School District, Texas, (/AAA/A+/) $288.87 million of PSF-insured unlimited tax school building bonds, Series 2023, with 5s of 2/2024 at 3.55%, 5s of 2028 at 3.06%, 5s of 2033 at 3.35%, 5s of 2038 at 3.90%, 5s of 2043 at 4.09%, callable 2/15/2028 except for bonds in 2038-2043 which are callable 2/15/2026.

Oyster Bay, New York, sold $125 million of bond anticipation notes, Series 2023, to J.P. Morgan Securities LLC. The BANs, due 8/23/2024, were sold with a 4.75% coupon at 3.42%.

NYC sees good retail, institutional demand

New York City said it received over $789 million of orders during the retail order period for its sale of about $1.02 billion of general obligation bonds this week.

During the institutional order period, the city received over $5.1 billion of priority orders, which made the deal about 5.8 times oversubscribed.

Given investor demand, institutional yields were lowered three basis points in 2027 to 2029, 2033 to 2035, 2044 and 2045; five to six basis points in 2025 to 2026 and 2046 to 2048; by seven to eight basis points in 2036 to 2039; and by 10 basis points in 2040 to 2043 and in 2051 and 2053.

Final yields ranged from 2.93% to 4.35%.

The bonds were underwritten through a syndicate led by book-running lead manager Loop Capital Markets. BofA Securities, Citigroup, J.P. Morgan, Jefferies, Ramirez & Co., RBC Capital Markets, Siebert Williams Shank and Wells Fargo Securities served as co-senior managers.

Proceeds will be used to fund capital projects and convert some floating-rate bonds to fixed-rate bonds.

Secondary trading

Massachusetts Bay Transportation Authority 5s of 2024 at 3.25%. Maryland 5s of 2024 at 3.28%.

Georgia 5s of 2026 2.96%. California 5s of 2027 at 2.77%. Ohio 5s of 2028 at 2.83%. New York City 5s of 2028 at 2.89%.

Minnesota 5s of 2030 at 2.72%. Tribes 5s of 2030 at 2.76%. Minnesota 5s of 2033 at 2.79%.

New York City TFA 5s of 2048 at 4.00%. New York City TFA 5s of 2053 at 4.07%.

AAA scales

Refinitiv MMD’s scale was bumped two basis points on bonds from 2024-2037: The one-year was at 3.26% (-2) and 3.10% (-2) in two years. The five-year was at 2.77% (-2), the 10-year at 2.70% (-2) and the 30-year at 3.69% (unch) at 3 p.m.

The ICE AAA yield curve saw cuts on the short end: 3.28% (+2) in 2024 and 3.13% (+1) in 2025. The five-year was at 2.74% (-1), the 10-year was at 2.69% (-1) and the 30-year was at 3.68% (unch) at 4 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve saw bumps on the short end: 3.27% (-2) in 2024 and 3.10% (-2) in 2025. The five-year was at 2.78% (-2), the 10-year was at 2.72% (-2) and the 30-year yield was at 3.68% (unch), according to a 4 p.m. read.

Bloomberg BVAL was bumped: 3.19% (-1) in 2024 and 3.09% (-1) in 2025. The five-year at 2.76% (-1), the 10-year at 2.70% (unch) and the 30-year at 3.75% (unch) at 4 p.m.

Treasuries saw losses.

The two-year UST was yielding 4.842% (+5), the three-year was at 4.513% (+9), the five-year at 4.236% (+11), the 10-year at 4.109% (+10), the 20-year at 4.431% (+9) and the 30-year Treasury was yielding 4.266% (+9) at the close.

CPI leaves analysts split

“Can the Fed declare victory?,” asked Jeffrey Cleveland, chief economist at Payden & Rygel. ”My take: no, not after two reports. Also, the Fed wants to see a ‘2-handle’ on core inflation year-over-year before it declares victory.”

With core CPI 4.7% higher than a year ago, “we are a ways away,” he said. “Obviously if we can maintain 0.2% monthly readings, we could be there soon — perhaps by early 2024. But there’s no guarantee.”

Sean Snaith, director of the University of Central Florida’s Institute for Economic Forecasting, sees a “steady, long” road to taming inflation under control. “Without future interest rate hikes and a softening of the labor market, we’ve still got a long way to go.”

“The pick-up in core services inflation to 0.4% m/m from 0.3% in June will be seen by the Fed as grounds for caution,” according to Fitch Ratings Chief Economist Brian Coulton. “Rents just don’t seem to be slowing by much at all on a m/m basis and given the 34% weight of shelter in the CPI, this is significant.”

Despite the trend toward slower inflation, Morning Consult Chief Economist John Leer warns, ”future progress in the fight against inflation will be harder, not easier.”

Demand for housing, he noted, has weathered the storm of increased mortgage costs “and there are good reasons to believe housing inflation will accelerate once again by the end of the year.”

Also of concern is the length of time inflation has been high, which makes it more likely to become entrenched, he said.

“The question we should all be asking is how long the Fed is willing to accept core inflation above 4%,” Leer noted. “My sense is that their tolerance is pretty low, meaning that we shouldn’t expect rate cuts this year.”

Mickey Levy, chief economist for Americas and Asia at Berenberg Capital Markets, a member of the Shadow Open Market Committee, noted, “Mounting evidence suggests that inflationary pressures are slowly but surely beginning to abate, with three back-to-back months of softening headline inflation and broadening disinflation among core inflation components likely to tilt the Fed toward another pause at its September 19-20 meeting.”

The report “is one more nail in the coffin for the September rate hike,” said Giuseppe Sette, president of Toggle AI. “Federal fund rates are already at a level commensurate with the current level of inflation.”

The Fed will hold rates, he said, and the hiking cycle is over.

Gurpreet Gill, global fixed income macro strategist at Goldman Sachs Asset Management, agrees. ”The latest CPI data reinforces our view that July likely marked the peak in the Fed’s hiking cycle, however, we will be closely monitoring the evolution of core PCE inflation and labor market rebalancing to determine whether the disinflation trend is durable.”

Despite the first acceleration in CPI on an annual basis since June 2022, Phillip Neuhart, director of market and economic research at First Citizens Bank Wealth, said, “the monthly pace of inflation remained steady and muted at 0.2%. This report gives the Fed latitude to keep the federal funds rate unchanged at their September meeting.”

Wall Street doesn’t expect a September rate hike, said Edward Moya, senior market analyst at OANDA. “Markets are growing confident that the Fed is done raising rates.”

The labor market weakening suggests prices will not reaccelerate, he added. “The Fed will have a fun time at Jackson Hole as there wasn’t anything from both the nonfarm payrolls and CPI report that would move members to tightening in September.”

While recent trends are “encouraging” and show inflation is slowing, Wells Fargo Securities Senior Economist Sarah House and Economist Michael Pugliese remain ”cautious about getting overly excited about a sustained return to the Fed’s 2% inflation target.”

Their base case expectation is the Fed has finished raising rates but won’t cut rates before next year.

But Chris Ainsworth, CEO of Pave Finance, doesn’t believe rates won’t go up. “We’re expecting the rate hikes to come in closer to four.”

Markets, he said, are doing what would be expected leading into a recession. “Things don’t look good right now, given what we would call sticky inflation.”

Government debt is high, Ainsworth added, and the higher cost of borrowing leads to “even more inflation.”

A soft landing is unlikely, he said. “The current Fed has shown a lack of foresight and ability to address monetary policy appropriately, and I don’t expect them to be able to do it properly now. The idea of a soft landing is great but with inflation where it is and unemployment, it would be extremely difficult.”

Mutual fund details

Refinitiv Lipper reported $278.449 million of inflows into municipal bond mutual funds for the week ending Wednesday following 989.852 million of outflows the week prior.

Exchange-traded muni funds reported inflows of $281.644 million versus of $675.259 million of outflows in the previous week. Ex-ETFs muni funds saw outflows of $3.195 million after $314.593 million outflows in the prior week.

Long-term muni bond funds had $444.929 million of inflows in the latest week after outflows of $695.590 million in the previous week. Intermediate-term funds had $80.979 million of inflows after $51.416 million of inflows in the prior week.

National funds had inflows of $303.621 million versus $883.558 million of outflows the previous week while high-yield muni funds reported inflows of $93.945 million versus outflows of $48.497 million the week prior.