Municipals were firmer Wednesday, but underperformed a U.S. Treasury rally that followed the June consumer price index report showed inflation cooling. Equities ended the session up.

Triple-A yields fell up to three basis points while UST saw yields fall by as much as 18 basis points.

Ratios rose as a result. The two-year muni-to-Treasury ratio Wednesday was at 62%, the three-year at 64%, the five-year at 65%, the 10-year at 68% and the 30-year at 90%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 60%, the three-year at 62%, the five-year at 61%, the 10-year at 66% and the 30-year at 89% at 4 p.m.

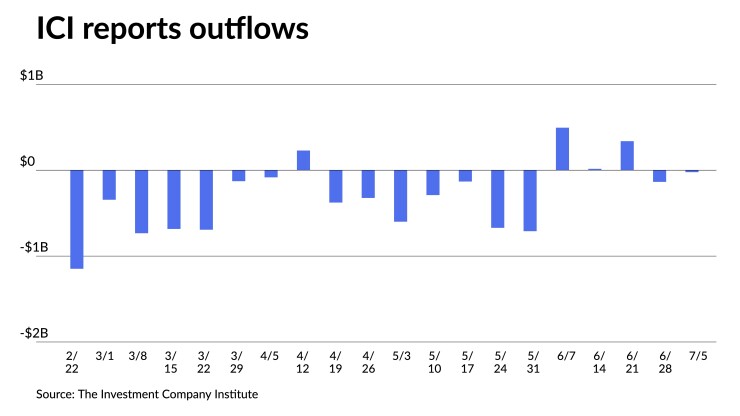

The Investment Company Institute reported investors pulled $23 million from municipal bond mutual funds in the week ending July 5, after $136 million of outflows the previous week.

“The bond market finally got the relief from inflation it was hoping for,” said Bryce Doty, senior vice president and senior portfolio manager at Sit Investment Associates.

The inverted yield curve, he said, “had become more of an indication the inflation relief was coming than anything else.”

Wednesday’s soft consumer price index report puts year-over-year inflation at 3.0%, which is well below the fed funds rates, he said.

“A significant ‘real’ fed funds rate means the Fed is currently severely restrictive,” Doty said.

Even the stubborn core CPI fell significantly from 5.3% year-over-year to 4.8%, he noted.

He expects “the yield curve inversion to lessen as investors digest the significance of [Wednesday’s] data.”

A combination of continued outperformance, strong credit, and attractive balance of risk to reward is fueling municipal bonds in the current environment, according to Cooper Howard, fixed income municipal strategist at Charles Schwab.

Spring reinvestment demand could produce continued outperformance — just as the market saw in June — as the third quarter progresses, according to Howard.

“Munis outperformed Treasuries and corporates in June and they may continue to perform well because supply is dwarfed by the amount of money that’s coming due via calls, maturities, or other redemptions,” he said.

He noted that “strong demand and low supply should help keep prices elevated.”

Muni yields should be constructive overall during the summer months, said Nuveen strategists Anders S. Persson and Daniel J. Close.

“The industry is now reinvesting $40 billion that entered the system July 1,” they said. “In aggregate, $105 billion is expected to be available to reinvest through the end of August.”

While state income taxes are starting to slow, Howard said he’s “not too concerned because many states have built their reserves to record levels and should be able to withstand a slowdown in revenues.”

The slowdown in revenues, he said, “is generally more pronounced for states with a large reliance on income tax revenues.”

On the economic side of the market, credit quality should remain strong — even if the economy slows — and slowing state income taxes are not too worrisome, Howard said.

Most munis “are very highly rated and should be able to manage through an economic slowdown,” he said.

Given the combination of attractive yields and strong credit conditions, he has “a positive view on the muni market over the remainder of the year.”

That includes little concern over state income taxes starting to slow.

“Many states have built their reserves to record levels and should be able to withstand a slowdown in revenues,” he said. “The slowdown in revenues is generally more pronounced for states with a large reliance on income tax revenues.”

In the primary market Wednesday, Piper Sandler & Co. priced for the New Caney Independent School District, Texas (Aaa//AAA/), $205.200 of unlimited tax school building and refunding bonds, Series 2023, with 5s of 2/2024 at 3.24%, 5s of 2028 at 2.84%, 5s of 2033 at 2.95%, 5s of 2038 at 3.40%, 5s of 2043 at 3.74%, 5s of 2048 at 3.92% and 5s of 2053 at 4%, callable 8/15/2033.

BofA Securities priced for the Florida Insurance Assistance Interlocal Agency (A2///) $125 million of variable rate insurance assessment revenue bonds, Series 2023A-2, with 2.4s of 9/2032 at par.

In the competitive market, Colorado sold $450 million of Education Loan Program tax and revenue anticipation notes to BofA Securities, with 5s of 6/2024 at 3.30%, noncall.

The city also sold $42.775 million of combination tax and surplus revenue certificates of obligation, Series 2023B, to Wells Fargo Bank, with 5.25ss of 2/2026 at 4.55%, 5.25s of 2028 at 4.35%, 5.25s of 2033 at 4.55%, 4.875s of 2038 at par and 4.9s of 2053 at 5.05%, callable 2/15/2033.

The city sold $18 .525 million of combination tax and surplus revenue certificates of obligation, Series 2023A, to Wells Fargo Bank as well, with 5s of 2/2024 at 3.22%, 5s of 2028 at 2.85%, 5s of 2033 at 2.90%, 5s of 2038 at 3.40% and 4s of 2043 at 4.15%, callable 2/15/2033.

2H23 outlook

Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel expect more of the same for the market in the second half of the year, leading to returns of around 5% for investment grade munis for the year.

Barclays expects the IG index to return 5%-5.5%, the high-yield index 7.5%-8% and taxable munis at 3%-3.5% after their spreads widen slightly in 2H23.

Much will depend on rates, but if they stay range-bound, Barclays strategists expect munis should perform relatively well.

Technicals should remain solid, “despite a likely increase in supply in 2H23, with stronger demand from retail, mutual funds and foreign investors,” they said.

They think ”investors should be able to generate coupon income, possibly with marginal price appreciation.”

While they did not change their total return projections for high-grade munis for the year, they said they “are becoming more positive on lower-rated high-grade credits, as well as on high yield, and expect stronger returns this year for these market segments.”

Barclays strategists “also expect credit spreads to continue to tighten, but there is limited upside, in our view, given that, at current yields, spreads represent a smaller share of total bond yields, so they are unlikely to return to pre-2022 levels unless yields adjust much lower.”

While there may be some speed bumps in 2H23, such as increased geopolitical risks or further volatility in the banking sector, they think “the main risks to our forecast stem from a stronger U.S. economy and stickier inflation, which would result in more aggressive actions by the Fed and likely higher rates.”

If the U.S. economy is weaker than expected, they think there will likely to be “lower rates, and although credit spreads might not tighten or could even widen slightly, tax-exempt returns might be even stronger than in our base case.”

Secondary trading

Maryland 5s of 2024 at 3.08%. Metropolitan Council, Minnesota, 5s of 2025 at 2.91%. NYC TFA 5s of 2026 at 2.86%.

Florida 5s of 2028 at 2.65%. Georgia 4s of 2028 at 2.69%. Wisconsin 5s of 2029 at 2.72% versus 2.74% Tuesday.

Triborough Bridge and Tunnel Authority 5s of 2033 at 2.90% versus 2.93% Tuesday and 2.98%-2.96% Monday. California 5s of 2034 at 2.74%-2.71%. University of California 5s of 2035 at 2.63%.

Metropolitan Water District of Southern California 5s of 2053 at 3.66%-3.67% versus 3.66% Monday. Massachusetts 5s of 2053 at 3.92%-3.90% versus 3.95% Tuesday and 3.95%-3.94% Monday.

AAA scales

Refinitiv MMD’s scale was bumped up to two basis points: The one-year was at 3.07% (-2) and 2.95% (-2) in two years. The five-year was at 2.65% (-2), the 10-year at 2.64% (unch) and the 30-year at 3.56% (unch) at 3 p.m.

The ICE AAA yield curve was bumped one to two basis points: 3.06% (-1) in 2024 and 2.98% (-2) in 2025. The five-year was at 2.64% (-2), the 10-year was at 2.61% (-1) and the 30-year was at 3.60% (-1) at 4 p.m.

The IHS Markit municipal curve was bumped up to two basis points: 3.07% (-2) in 2024 and 2.96% (-2) in 2025. The five-year was at 2.65% (-2), the 10-year was at 2.64% (unch) and the 30-year yield was at 3.56% (unch), according to a 3 p.m. read.

Bloomberg BVAL was bumped two to three basis points: 3.02% (-3) in 2024 and 2.92% (-3) in 2025. The five-year at 2.62% (-3), the 10-year at 2.57% (-3) and the 30-year at 3.55% (-2) at 4 p.m.

Treasuries rallied.

The two-year UST was yielding 4.742% (-15), the three-year was at 4.380% (-18), the five-year at 4.074% (-16), the 10-year at 3.862% (-12), the 20-year at 4.138% (-8) and the 30-year Treasury was yielding 3.950% (-7) near the close.

CPI print shows inflation cooling

Inflation cooled in June, with the CPI print rising 0.2% month-over-month, below expectations.

Wednesday’s “softer-than-expected print with signs of pandemic-era distortions fading provides additional evidence that disinflation is occurring in real-time,” said Wells Fargo Securities senior economist Sarah House and economist Michael Pugliese

Looking ahead, they believe “the more moderate pace of price growth signaled by the June CPI to continue.”

The decline in core inflation to 0.2% month-over-month from 0.4% in May “will be welcomed by the Fed, but this is really only a small step in the right direction,” said Brian Coulton, Fitch Ratings chief economist.

Core inflation is under 5% on “both a year-on-year and three-month annualized basis, which is far too high,” he said.

“In the context of a still-tight labor market and sticky wage growth, the Fed’s recent concerns about inflation persistence are not going away,” Coulton said.

Wells Fargo strategists noted “a timely and sustained return to the FOMC’s 2% inflation target remains far from assured.”

While wages are longer be accelerating, they said the “tight jobs market is keeping labor costs growing in excess of the range that is consistent with 2% inflation over time.”

“The trend that investors have been waiting for is finally here, softer core CPI prints or hints of pre-COVID normality,” said Alexandra Wilson-Elizondo, deputy chief information officer of multi asset solutions at Goldman Sachs Asset Management.

The downside surprise “on both core and headline numbers allows us to avoid a terminal rate that is gradually scaling up,” she said.

While it the CPI print is only one data point, Wilson-Elizondo said “this will buy investors time and give them the opportunity to catch their breath.”

“It is enough on a standalone basis for the market to put in question the Fed’s dot projections of two additional hikes left this year and consequently pull interest rate volatility down,” she said.

Morning Consult chief economist John Leer does not expect the Fed to stop raising rates.

“The Fed cares primarily about the trend in core PCE inflation, which has been persistently elevated for the past six months,” he said. “One month of encouraging CPI data isn’t enough for the Fed to make a dovish pivot, particularly as it seeks to maintain credibility with financial markets.”

The improvement relative to the 4.6% pace of core inflation in the first half of 2023 “will likely be enough to where the FOMC believes it can sit and wait for the effects of prior tightening to work through the economy after one additional 25 bps hike at its next meeting on July 26,” according to Wells Fargo strategists.

The Fed is still “likely to hike by 25 basis points, rightly or wrongly, as the labor market data on Friday simply wasn’t good enough,” said Craig Erlam, a senior market analyst at OANDA.

He noted “the wages component was quite the opposite and will likely convince the FOMC that one more hike is warranted, which is what markets are still heavily pricing in.”

Chris Ainsworth, CEO of Pave Finance, said there are likely to be two additional 25 basis point rate hikes, but he believes the Fed has already raised rates too much,

“This won’t change the Federal Reserve’s plan to hike again,” he said.

Ainsworth said it’s not so much a function of raising rates but rather “the Fed managing forward-looking inflation expectations.”

The Fed “got it wrong a year ago, so they have to be overly aggressive to ensure that forward-looking inflation expectations come back down,” he said.

Erlam argued the Fed’s possible rate hike in July could be its last of the year, and he said if “we can see any further signs of progress over the summer then that will likely end the debate altogether, shifting the conversation from how many more hikes to the timing of the first cut.”

Wells Fargo strategists believe rate cuts are a long way off due to “the underlying trend in inflation likely to be stuck closer to 3% than 2%.”

Primary to come:

Grant County Public Utility District, Washington (/AA/AA/), is set to price Thursday $193.395 million of Priest Rapids Hydroelectric Project revenue and refunding bonds, Series 2023A. J.P. Morgan Securities.

Los Angeles (Aa2//AA/) is set to price Thursday $174.740 million of solid waste resources revenue bonds, Series 2023A. J.P. Morgan Securities.

The Michigan State Building Authority(Aa2//AA/) is set to price next week $114.085 million of Facilities Program multi-modal revenue bonds, Series I, term 2058. Barclays.

The Chapel Hill Independent School District, Texas (/AAA//), is set to price Thursday $100 million of PSF-insured unlimited tax school building bonds, Series 2023. Piper Sandler & Co.

The New Mexico Mortgage Finance Authority (Aaa///) is set to price Thursday $100 million of tax-exempt non-AMT single-family mortgage program Class I bonds, Series 2023C, serials 2024-2035, terms 2038, 2043, 2048, 2053, 2054. RBC Capital Markets.

Christine Albano contributed to this story.